Where Can You Get A Small Business Loan?

It is becoming easier for small business owners to acquire capital with all of the nontraditional lending options available. The Hartford’s 2014 Small Business Success Study found that 46 percent of business owners believe it is slightly or not difficult at all to get a business loan. In 2012, only 7 percent of business owners were of that opinion. In the same study, 36 percent of participants used personal savings, retirement savings and funding from family and friends.

It is becoming easier for small business owners to acquire capital with all of the nontraditional lending options available. The Hartford’s 2014 Small Business Success Study found that 46 percent of business owners believe it is slightly or not difficult at all to get a business loan. In 2012, only 7 percent of business owners were of that opinion. In the same study, 36 percent of participants used personal savings, retirement savings and funding from family and friends.

Peer-to-peer lending sites and crowd funding sites are becoming more popular, according to Forbes, but traditional sources are also offering new funding programs.

- Bank or credit union loans. Due to their access to checking and savings deposits, banks are able to offer loans at low interest rates. Community banks and credit unions are great options for small business owners, but they are selective and usually have a lengthy application process that make take weeks from when you begin to work with them to when you get the capital that you are looking for. They must compete for business from the pool of local businesses making deposits. Additionally, banks are selective and it can be difficult to qualify for a bank loan, however, as finances are not in the best place when a business is seeking capital. Bank loans usually have fixed repayment terms as well, they do not take into account a businesses' profitability or lack-thereof when looking at when the amount loaned will be repaid.

- SBA loans. These loans are low cost and don’t require much credit history, but they take a long time. There is extensive paperwork, so this is not the best option for a business owner in need of quick financing. SBA loans are long-term, so the payment terms should not outlive the purchase. SBA loans are also in short supply, there is not an unlimited amount of them available and they tend to go relatively quickly so it isn't always a sure bet for someone looking for capital for their business/

- Personal credit cards. This is a better option than business credit cards as they have consumer protection. Credit cards have lower interest rates and fees than other lending services. It is important to keep records of personal credit card spending as the information will be needed for expense reports. Also make sure that you are fully aware of all of the fees and whether you are taking the money as a purchase, balance transfer or a line of credit. Read all of the terms and conditions carefully and make sure that you know what you are agreeing to, what the terms of repayment are and what the rates are for the money that you get from the credit card company.

- Alternative loans. This option which includes merchant cash advances and peer-to-peer lending provides quick access to capital, but often comes at a higher cost than traditional loans or small business loans. It is important to carefully scrutinize the terms of alternative loans to determine exactly how much it costs to borrow. The annual percentage rate is helpful in calculating the interest rate and fees associated with a loan. One of the benefits of merchant cash advances is that they can work with your credit card processor and they get repaid a percentage of the profits of the business, so you are repaying back the advance at the pace that is right for your business and your businesses' profitability.

- Personal sources. When savings are not earning the interest they could from lending to your business, borrowing from friends and family is also an option. The wisdom of this decision does depend heavily on the people involved and your trust.

With so many options, all having pros and cons, it can be difficult to decide on the best source for a small business loan or a merchant cash advance. Small business owners must first evaluate their capital needs and ensure that the investment will not erode all profitability. Evaluate the ROI expected on the investment and what benefit the added capital will bring into the business. The decision must also be based on the turnaround time needed, cost of the loan and ability to meet the requirements. Also make sure to evaluate the rates and the terms of repayment to make sure that they meet your business needs and that it is the best fit for your business. Once the decision has been made and the loan is approved, small businesses can enjoy increased access to cash and ability to meet goals.

More from News

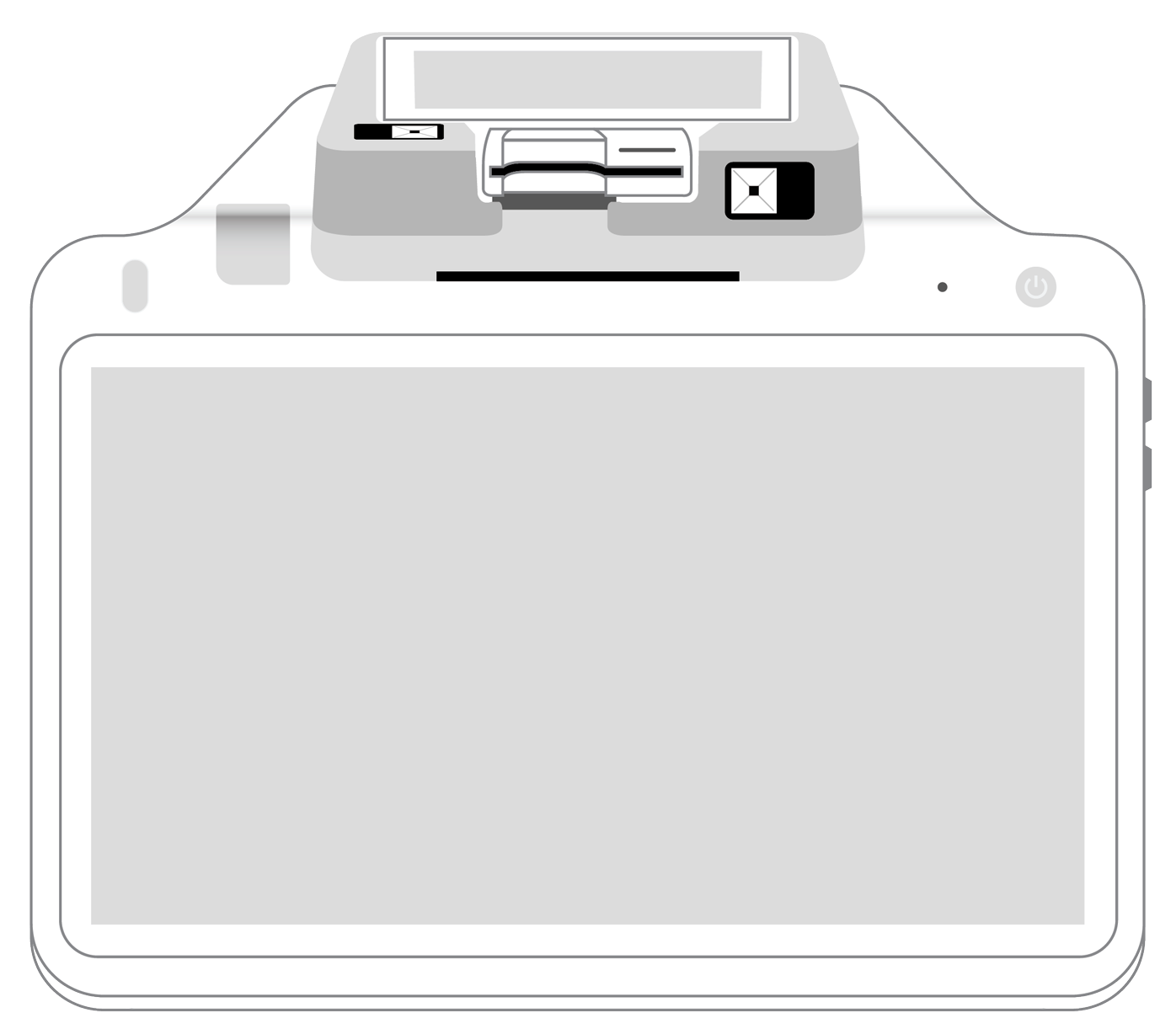

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||