When to Consider Raising Your Credit Card Limits

It's common for some banks and financial institutions to send out offers to increase the limit of your credit card from time to time. Yet many people worry that increasing the available limit on a credit card might simply increase the temptation to spend more, which leads to higher repayments.

It's common for some banks and financial institutions to send out offers to increase the limit of your credit card from time to time. Yet many people worry that increasing the available limit on a credit card might simply increase the temptation to spend more, which leads to higher repayments.

However, there are times when raising your credit card limit could be beneficial. Here are some occasions when it might be wise to increase the available limit on your credit cards.

Increase Your Credit Score

The credit scoring system determines a portion of your total score based on how much available credit you've used. For example, if you have a $2,000 limit and your outstanding balance is sitting at around $1,800, you're using 90% of your available credit, which has a negative impact on your credit score.

By comparison, if you raise your credit limit your card is no longer maxed out, as you're only using a portion of your available credit line. If you increase your limit to $3,000 and your outstanding balance stays at $1,800, you're only using 60% of your available credit, which helps to improve your credit score.

Easier Access to Additional Credit

If you're planning to apply for a personal loan, car loan or home loan, you can benefit from increasing your credit card limit. When the bank assesses your loan application, they'll check your credit score and look into how you handle any current debts you have outstanding.

When you have a credit card balance that is well below your available limit, you appear to be more financially responsible. The result is that you have a better chance of getting approved on a loan application. You're also more likely to qualify for a lower interest rate.

Access to Emergency Funds

Everyone is faced with unexpected bills and expenses from time to time, but what happens if you're faced with an emergency that you don’t have enough cash to cover? The car might break down, or the fridge could give up the ghost, or you might need emergency dental work done. Increasing your credit card limit gives you access to emergency funds when you need them most.

Take Advantage of Additional Perks

Did you know that some credit cards offer a range of extended warranties and insurance coverages if you use your card to purchase some items? If you purchase a new television with your credit card, the original manufacturer's warranty could be extended by up to 12 months, and it could also be covered in the event that it's damaged or stolen.

Likewise, if you pay for plane tickets using your credit card, you could be automatically covered by a range of travel insurances attached to your account. There's also the advantage of earning more rewards when you use your card to pay for larger items.

In order to use your credit card to pay for larger purchases and take advantage of the range of perks available, you may want to consider raising your credit limit. Just be certain that you're able to repay the amounts you spend in a timely manner, otherwise the interest charges you pay on your outstanding debt could negate any benefits you thought you were getting.

Related Reading

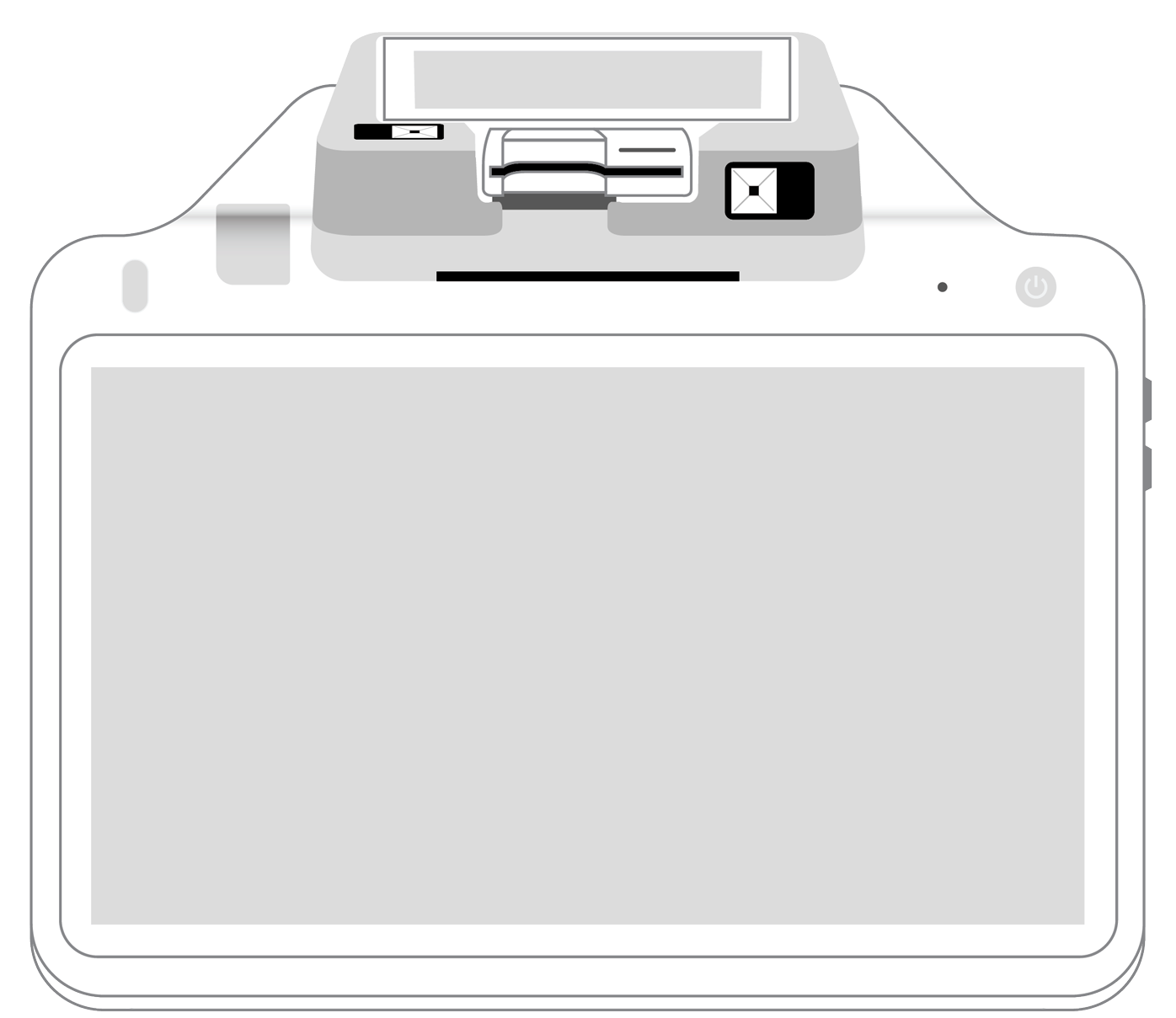

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||