What’s Not in Your Wallet? The Answer May Be “Money”

There are numerous studies and articles available that say we are heading towards a cashless society. Fewer people are using cash to pay for goods and services, and use of payment cards and mobile devices is on the rise – just about every new smartphone has a payment system on it (Apple Pay, Android Pay or Samsung Pay), and payment terminals are able to accept these new methods with just a tap. We already use payment cards and our smartphones to pay for inexpensive things like a cup of coffee that not long ago we never would have thought to use anything but cash to purchase. But South Korea is trying to become cashless by 2020, and for a while it looked like Sweden was well on its way, as well. Sweden’s homeless street vendors are equipped with credit card readers, banks are no longer accepting or dispensing cash, and churchgoers are tithing by ATM – but recently the government put a halt to the complete removal of cash.

There are numerous studies and articles available that say we are heading towards a cashless society. Fewer people are using cash to pay for goods and services, and use of payment cards and mobile devices is on the rise – just about every new smartphone has a payment system on it (Apple Pay, Android Pay or Samsung Pay), and payment terminals are able to accept these new methods with just a tap. We already use payment cards and our smartphones to pay for inexpensive things like a cup of coffee that not long ago we never would have thought to use anything but cash to purchase. But South Korea is trying to become cashless by 2020, and for a while it looked like Sweden was well on its way, as well. Sweden’s homeless street vendors are equipped with credit card readers, banks are no longer accepting or dispensing cash, and churchgoers are tithing by ATM – but recently the government put a halt to the complete removal of cash.

The idea of the United States becoming a true cashless society is intriguing. Removing cash may have many benefits, not the least of which would be not having to carry a wallet stuffed full with cash or credit cards anymore. Our money and credit would be tied to the Pay account and bank apps on our smartphones, so when leaving the house in the morning, our smartphones are the only thing we would need to carry. Purchasing goods and services would involve a simple tap or wave of our smartphones on a merchant’s POS terminal. On payday, you wouldn’t have to go to the bank to deposit your check or pull money out – just log into your bank’s app to move money between accounts.

In addition, the security safeguards on our phones (which are bound to only get better in the future) help to ensure our money is safe, unlike cash, which is easily stolen and impossible to replace – when it’s gone, it’s gone. An article by Megan McArdle in the New York Post states that some experts claim a cashless society may even make society itself safer – the lack of cash would result in declines in many types of crimes, including muggings, robberies of retail outlets and even large criminal enterprises, which rely on cash to fly under the radar of the government.

Even if the United States was to go cashless, there are some instances in which cash would still needed. In an article for Alternative Daily, Megan Winkler offers some examples of specific situations in which technology does not trump cash – shopping at farmer’s markets, tipping vendors, valets and bellhops on vacation and if card readers stop working at the grocery store. Additionally, Winkler says fellow blogger Laura Adams states it’s far easier to swipe a debit card than it is to part with physical cash, which can be an issue if you’re trying to budget your money.

It is likely that the United States will be more cashless than it currently is, possibly relying on a hybrid of cash and mobile payments, forming an omni-channel experience that gives consumers a choice. Colin Gordon’s blog post on NCR.com states that “there will remain a fundamental legal requirement that places a duty on banks to provide cash services as a basic feature of payment accounts. Banks would appear to have reduced their cash handling services too fast, resulting in a lack of access to cash in less populated areas in particular. These are the main observations of the government putting a halt to this full adoption and removal of cash.”

Whether or not the United States will become a truly cashless society remains to be seen. With the use of NFC and contactless payments increasing exponentially every year, it seems we are certainly on that path; however, as seen in examples above, even in a cashless society, some cash may still be necessary. It is definitely a fascinating idea, and it will be interesting to see what happens in the coming years.

More from News

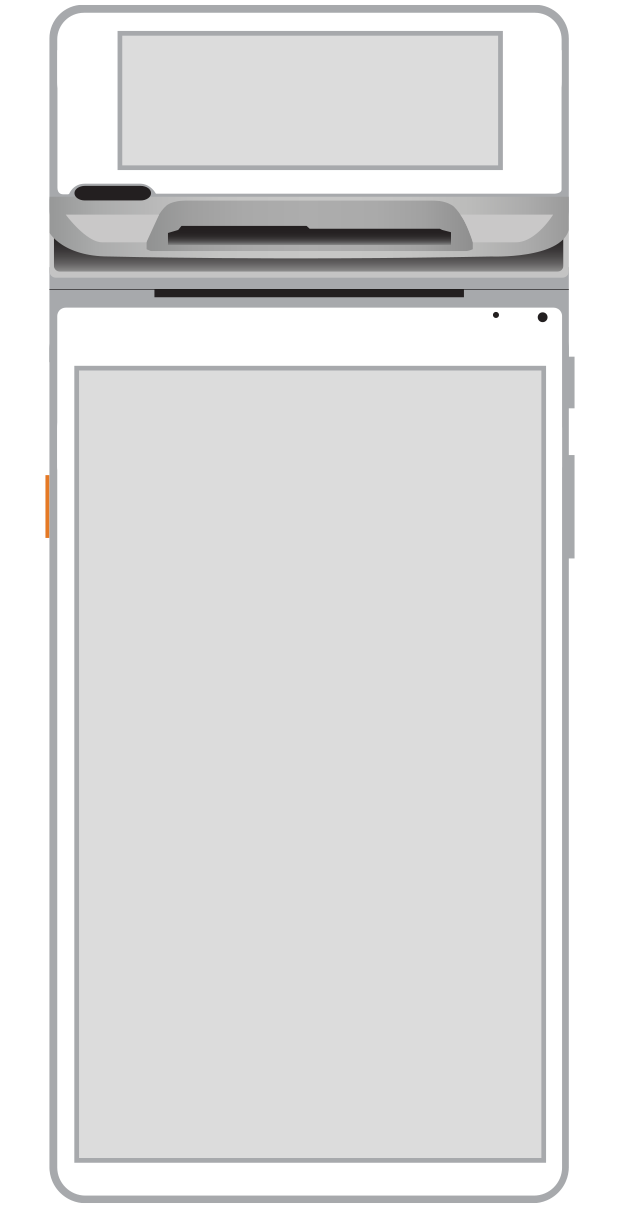

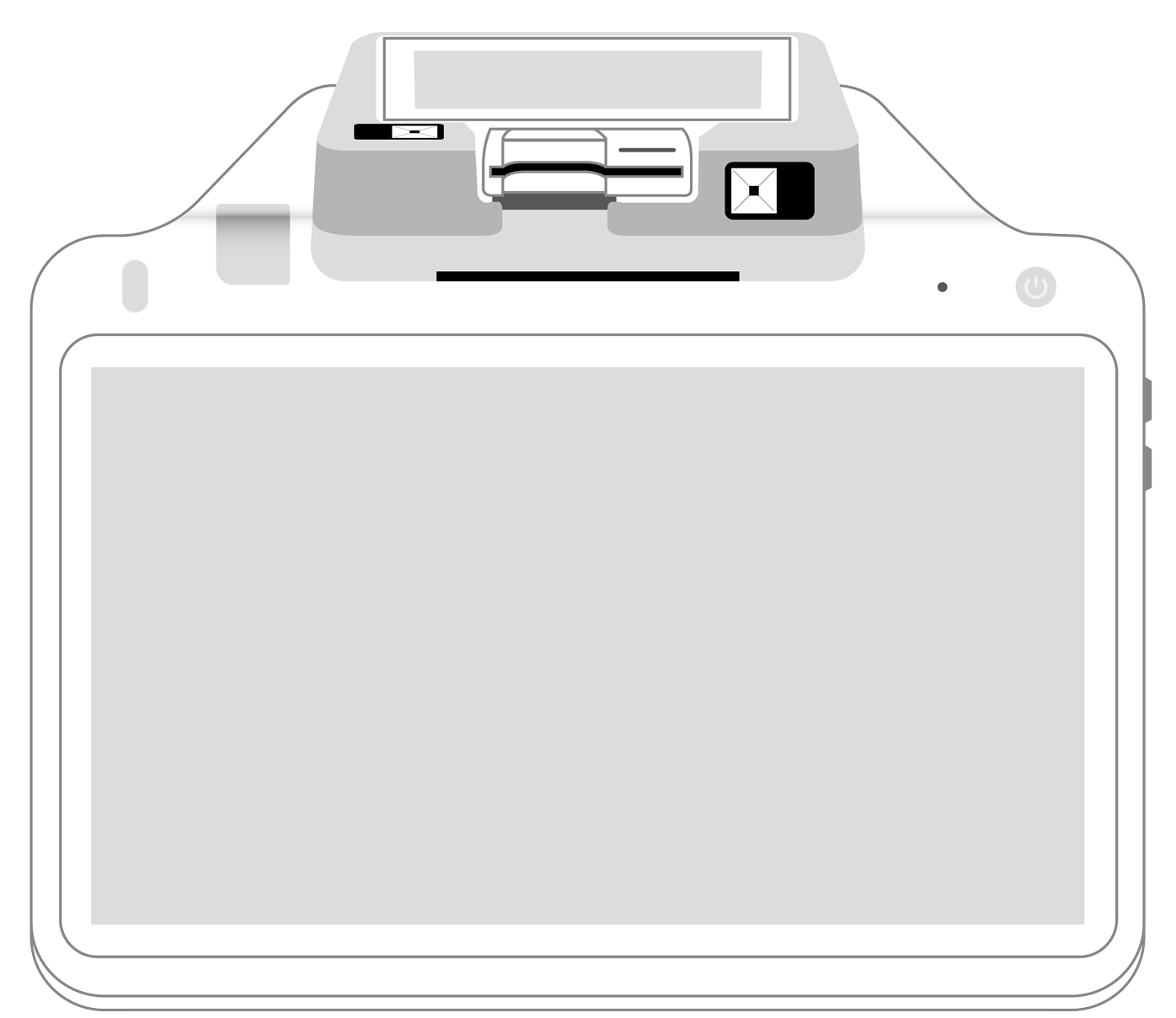

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||