What is the future of mobile payments? Technology, trends, and predictions.

Once an outlier in the payments industry, mobile wallets are seeing a rise in popularity, particularly among millennials and Generation Z. In fact, total mobile wallet payments are expected to reach $500 billion by 2020, up from $75 billion in 2016. Other new and growing trends are spurring the rise in adoption and making mobile payment processing a necessity if you’re looking to attract a wider audience and improve customer service.

Everything is about experience.

The moment when a customer makes a purchase is an important part of the total shopping experience. Any mistakes or delays can turn an otherwise pleasant interaction with a merchant into the stuff of one-star reviews. Businesses with fast, convenient, and diverse payment options will attract more customers and generate more brand loyalty than those using outdated technologies.

Adopting a mobile payment system positions your business to offer the kind of experience today’s customers demand. Checkout goes more quickly when customers pay with mobile devices, which means shorter wait times and fewer lines. You can save even more time on each transaction by offering digital receipts instead of taking the time to print out purchase information. Some point-of-sale (POS) systems allow you to save customer details, so future receipts can go directly to the email address you collect the first time a purchase is made.

Such features make cashless transactions seamless for both you and your customers. Recorded data can be used to create personalized recommendations and rewards. Young consumers are so fond of this level of convenience that 60% of them are willing to share bank account information with third parties to facilitate faster checkouts.

Flexibility with mobile Point-of-Sale (mPOS).

What could be more convenient than paying for purchases on the spot instead of having to walk to a terminal and wait to be served? You can offer your customers this option with a simple mPOS system. Although small businesses used to be the main market for these compact swipers, larger sellers are now adopting the technology as well to give customers more flexibility in where and how they pay. By 2021, 27.7 million mPOS devices are expected to be in use, and the worldwide market for mPOS technology could hit $81.3 billion in 2026.

North American businesses are leading the way in mPOS adoption, enjoying the freedom of being untethered from traditional checkout counters and even from physical store locations. With an mPOS device connected to your smartphone or tablet, you can process credit, debit and mobile payments anywhere, at any time. Purchase and payment data syncs with your POS system, which ensures both customer and inventory information are updated in real-time. Data is never stored on the processing device and all transactions are encrypted to ensure safety and privacy.

More businesses creating branded payment apps.

It didn’t take long for more big names to take a cue from Starbucks and Walmart and launch their own payment apps. In fact, merchants like Target, McDonald’s and Dunkin’ Donuts now let customers pay for purchases using branded apps. Better still, 30% of consumers say they spend more when they use this payment method.

Creating a mobile app can not only boost sales but also increase brand loyalty. With your own app, you can get a sense of customers’ buying habits and start providing customized rewards, which people return to your store or website to redeem. Customers can track their own purchase histories and manage reward points or discounts right from their phones or through an online dashboard. Offering these kinds of “helpful or relevant” brand experiences prompts repeat visits from 9 out of 10 customers.

An app is also the perfect platform for location-based marketing. Customers can opt in to receive push notifications when they’re in the vicinity of your store, which alert them to special sales and discounts. They then have the chance to earn more rewards if they redeem the discounts on purchases made using the app.

Device use is expanding beyond smartphones.

At a time when many in older generations are only just getting used to the sight of people paying for purchases with their smartphones, other devices are starting to appear on the scene. Around the world, 12% of online adults currently own smartwatches. Smartwatch use among millennials is even higher, around 14%, and 11% of those in Generation Z are also in on the trend. The smartwatch market, valued at $312.4 billion in 2018, is expected to grow to more than $1.12 trillion by 2026, with unit sales possibly reaching 260 million in 2023.

Numerous other wearables are starting to come equipped with mobile payment technology. Health-conscious consumers who never go anywhere without their fitness trackers can rely on options like Fitbit Pay or Garmin Pay to cover their purchases. Bluetooth-enabled jewelry, such as Ringly rings and bracelets and the Token ring put payments right “at hand.” Even clothing companies are entering the market with items like the contactless jacket from British company Lyle & Scott, which is manufactured with a payment chip embedded in the right-hand cuff.

With these new technologies, a consumer could conceivably leave the house to complete a day’s errands taking nothing more than a driver’s license, car keys and a small piece of wearable tech. However, stronger security must accompany wider adoption of this technology to prevent the risk of fraud and identity theft. Banks issuing the cards linked to wearable tech need to implement more reliable authentication methods and set higher standards to protect the personal data of consumers.

Boosting mobile wallet adoption.

Despite advances in mobile payment technology, a 2017 report by Mintel showed about three-quarters of consumers didn’t see a reason to switch from their current payment methods. Seventy-one percent still preferred to use credit or debit cards, and 55% cited concerns about mobile wallet security as part of the reason for sticking with plastic.

The same report showed some consumers simply need an incentive to give mobile payments a try. Forty-four percent said they would switch if they could earn rewards and 43% would use a mobile option if coupons were offered. A better understanding of the speed and convenience of mobile payments might prompt other reluctant consumers to start using their mobile devices instead of physical cards.

However, many who are already on board with mobile payments find there are few businesses equipped to accept them. Around 40% of mobile wallet users are more likely to seek out stores where they can pay with their mobile devices, so it’s important to start advertising when your establishment adopts the necessary technology and to educate your employees regarding its use. Signage or stickers indicating which forms of mobile payments you accept attract tech-savvy customers and set your store apart from those without mobile options.

Equipping your POS system for mobile payment processing isn’t hard. Better still, it’s one of the smartest changes you can make in light of the current movement toward a cashless society. With total mobile payment use in U.S. stores set to hit $503 billion by 2020, this “wave of the future” is quickly becoming an everyday reality your business needs to embrace.

More from Business tips

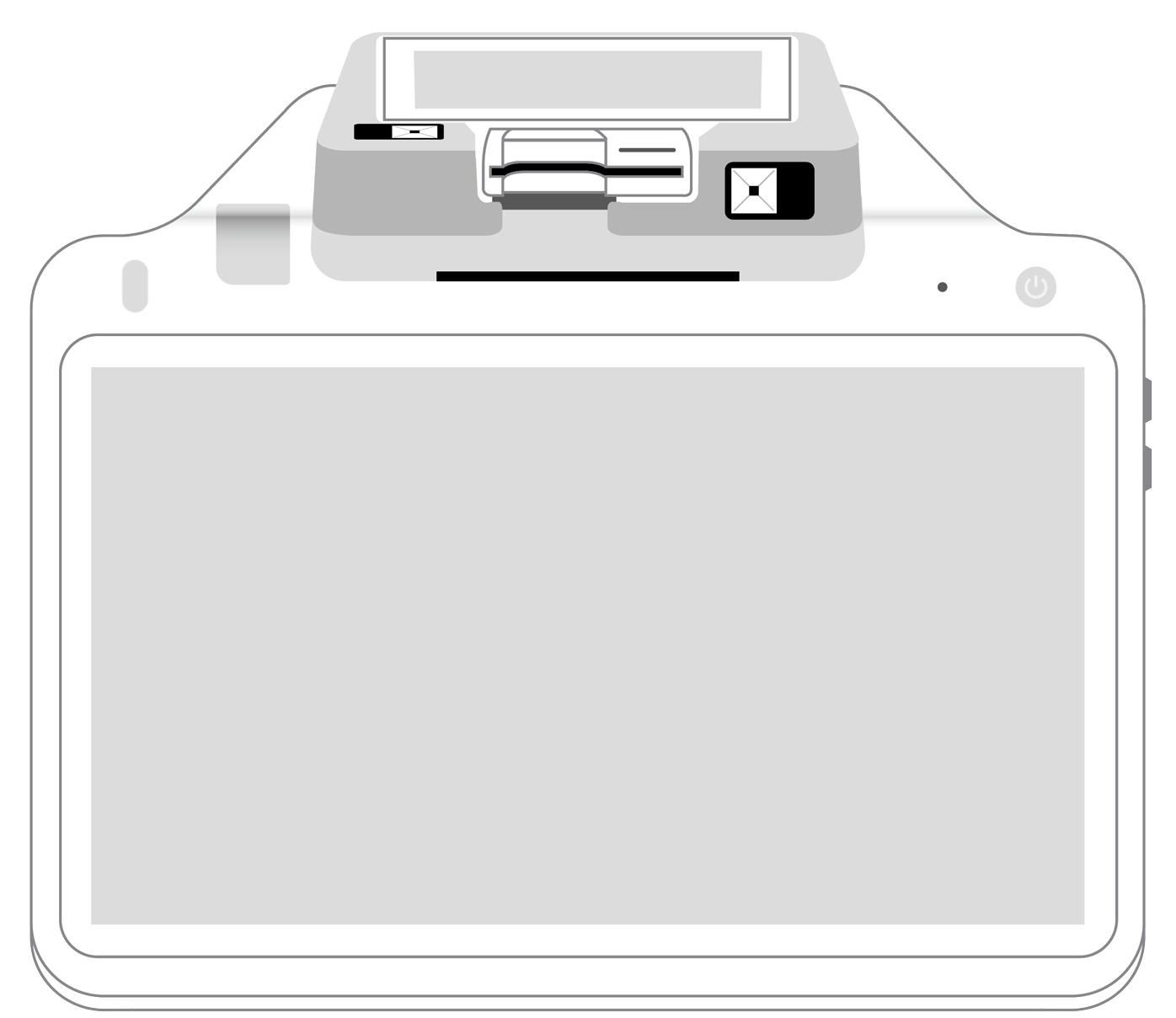

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||