Chargebacks: What You Need to Know

As a business owner or merchant, there will undoubtedly come a time where you are going to experience a chargeback. Not only is the process of going through a chargeback a hassle, but it can also cause an unexpected expense on behalf of the merchant. If you’re a small business, unexpected costs can wreak havoc on your bottom line and could even have a negative effect on your business. So, let’s take a look at exactly what a chargeback is; some of the common reasons for chargebacks; what a merchant should do when they receive a chargeback notification; and steps they can take to avoid chargebacks.

As a business owner or merchant, there will undoubtedly come a time where you are going to experience a chargeback. Not only is the process of going through a chargeback a hassle, but it can also cause an unexpected expense on behalf of the merchant. If you’re a small business, unexpected costs can wreak havoc on your bottom line and could even have a negative effect on your business. So, let’s take a look at exactly what a chargeback is; some of the common reasons for chargebacks; what a merchant should do when they receive a chargeback notification; and steps they can take to avoid chargebacks.

What is a Chargeback and what are the common reasons for them?

A chargeback, or payment dispute, is a cardholder or bank dispute with an individual or merchant that accepted a credit card payment for goods or services using the disputing cardholder’s account information. It is possible that the customer didn’t recognize the charge, did not receive the goods or services, or even felt that the quality of goods and services was not as advertised. Occasionally, chargebacks occur as the result of credit card fraud; someone wrongfully using the customer’s identity or card to make a purchase.

What is a Merchant to do?

Knowing what you, as the merchant, need to do to help expedite this process is critical so that you can address the dispute as quickly as possible. First, a merchant must provide a legible copy of the transaction receipt to the credit card processor. Any information that can bolster the position of the merchant is valuable information to share at this point. The ISO/acquirer is required to provide this information to the card issuer, so it is critical that a merchant is responsive and timely in addressing this request. Otherwise, the merchant runs the risk of facing fees. So, it is best to respond in a timely manner to the notification of a chargeback when the ISO/acquirer reaches out.

When a chargeback notification is received, it is best the merchant do the following:

- Read and follow the instructions in the notification for how to respond.

- Respond by or before the due date disclosed on the notification.

- Be sure to provide “compelling” information that the true card holder authorized the transaction, received the goods or services, or benefited from the transaction.

- Examples of “compelling” information

- Evidence that the merchant swiped or dipped, and received an authorization approval or the cardholder’s signature.

- Correspondence between the cardholder and merchant that proves the merchant communicated with the cardholder, and that the card holder acknowledged the validity of the transaction.

- Proof of delivery of goods or rendering of services

How to Avoid Chargebacks

To help avoid chargebacks, you should be prepared and know your rights so you don’t incur unnecessary losses for your business. Merchants should act promptly when customers with valid disputes deserve credits and let cardholders know of any pending credits. They should also respond to/address all of the cardholder’s pertinent claims. It is always encouraged to make sure you disclose your refund policy at the point of sale, so consumers have that information readily available.

If you incorporate some simple practices to help protect you and your business, you should be able to avoid most headaches that can arise as a result of going through the dispute process. If you own a business and accept credit cards, chargebacks are bound to happen to you at some point. So, it is always best to be informed, prepared and capable of handling the situation when it arises.

Related Reading

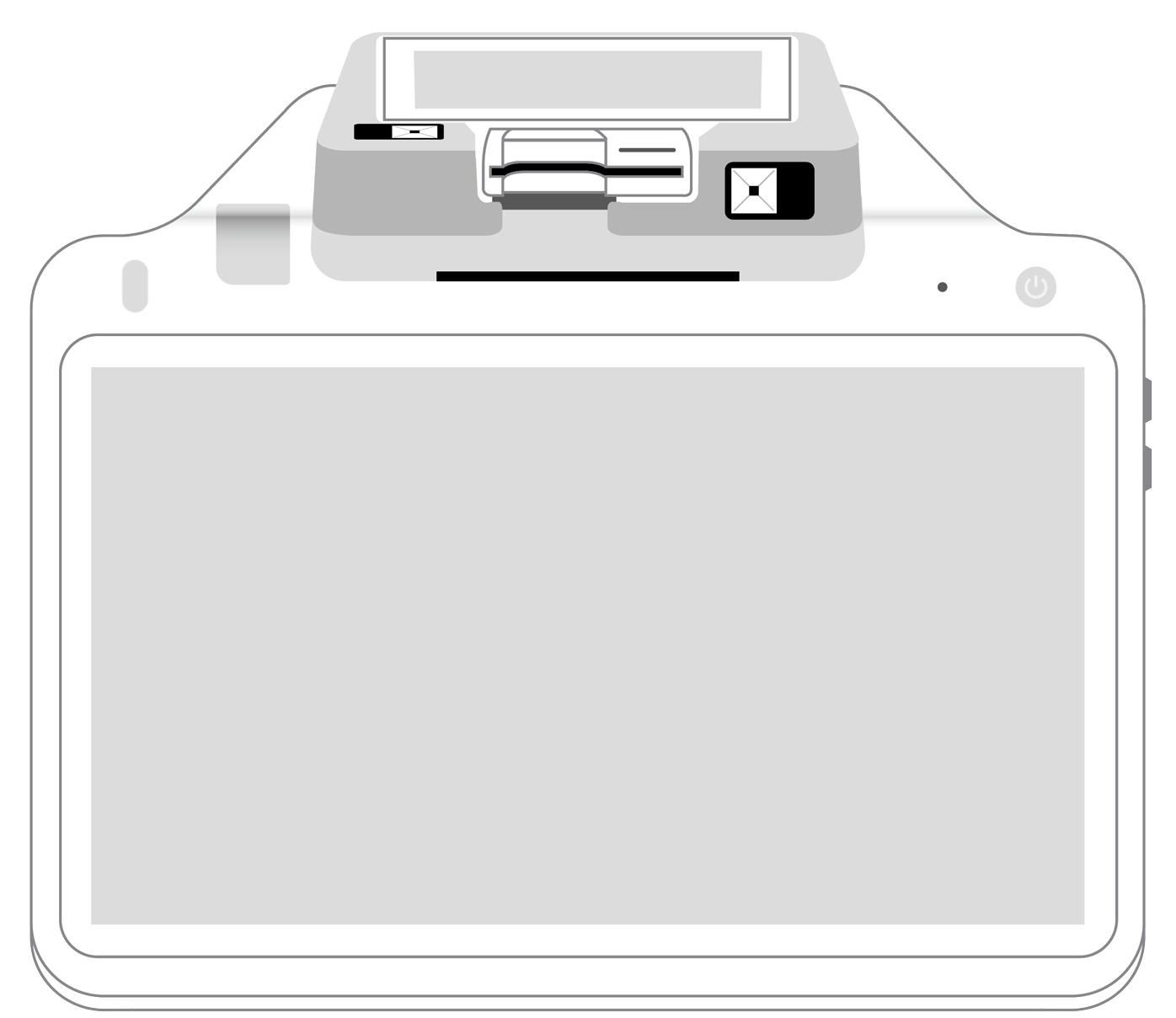

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||