What does the future of digital payments look like?

Although the initial adoption of digital payments has been slow, big changes are coming in the payment industry. If you’ve been wondering whether it’s time to upgrade your payment processing equipment, these trends offer valuable insights into the potential benefits of embracing digital.

Cashless transactions.

All forms of cashless payments, including credit and debit, rose 11.2% between 2014 and 2015, suggesting consumers are continuing to move away from cash in favor of plastic and smartphones. Digital payments alone are expected to reach $726 billion by 2020, driven in part by an increase in smartphone transactions in developing markets. A 21.6 percent increase from 2014 to 2015 shows other countries are leading the way in digital, although the rise of a younger generation of consumers may boost adoption rates in the U.S., as well.

Experience-focused.

Shopping is all about customer experiences and it’s hard to beat digital payments when you’re looking to deliver speed and efficiency. As far as consumers are concerned, the less hassle involved in shopping and paying, the better. Digital payments have the potential to create a truly frictionless payment environment, so payment providers will have to focus on improving accuracy to allow for faster processing at checkout.

Greater rewards.

Rewards programs offer significant incentives for customers to make the switch to digital payments. Thanks to location-based marketing using push notifications and SMS texts, businesses can now send coupons and one-time deals to customers as they approach or walk by stores. Digital payments provide more data to create hyper-personalized offers and the technology makes it possible to redeem these rewards automatically at the time of checkout. Sixty-six percent of customers look for this feature, making it a strategic way to differentiate your brand.

Biometric security.

Unfortunately, innovations in digital payments will inevitably be accompanied by innovations in fraud. After all, hackers are up on the trends, too and are always looking for new ways to exploit systems where a large amount of data is collected, transferred, and stored. To prevent fraud and identity theft, security must increase in complexity as digital payments continue to become more popular. Luckily, the latest in biometrics and other advanced authentication methods may offer a viable solution.

Wider acceptance.

The youngest market segment, Generation Z, is set to make up 40% of consumers in the U.S. by 2020. Their desire for digital payment options will make wide adoption of appropriate technologies necessary in many industries. It’s up to top players in the payments space to collaborate with banks, retailers, and other establishments to improve the integration of payment methods across platforms so that customers are able to choose preferred forms of payment without sacrificing experience or quality of service.

Upgrading your payment processing equipment to accept digital payments prepares you to serve more customers as new trends continue to shape the payments industry. When you add digital options, you position your brand as forward-thinking and show customers you’re ready to cater to the desire for convenience, speed, and personalization in a rapidly changing modern market.

More from Business tips

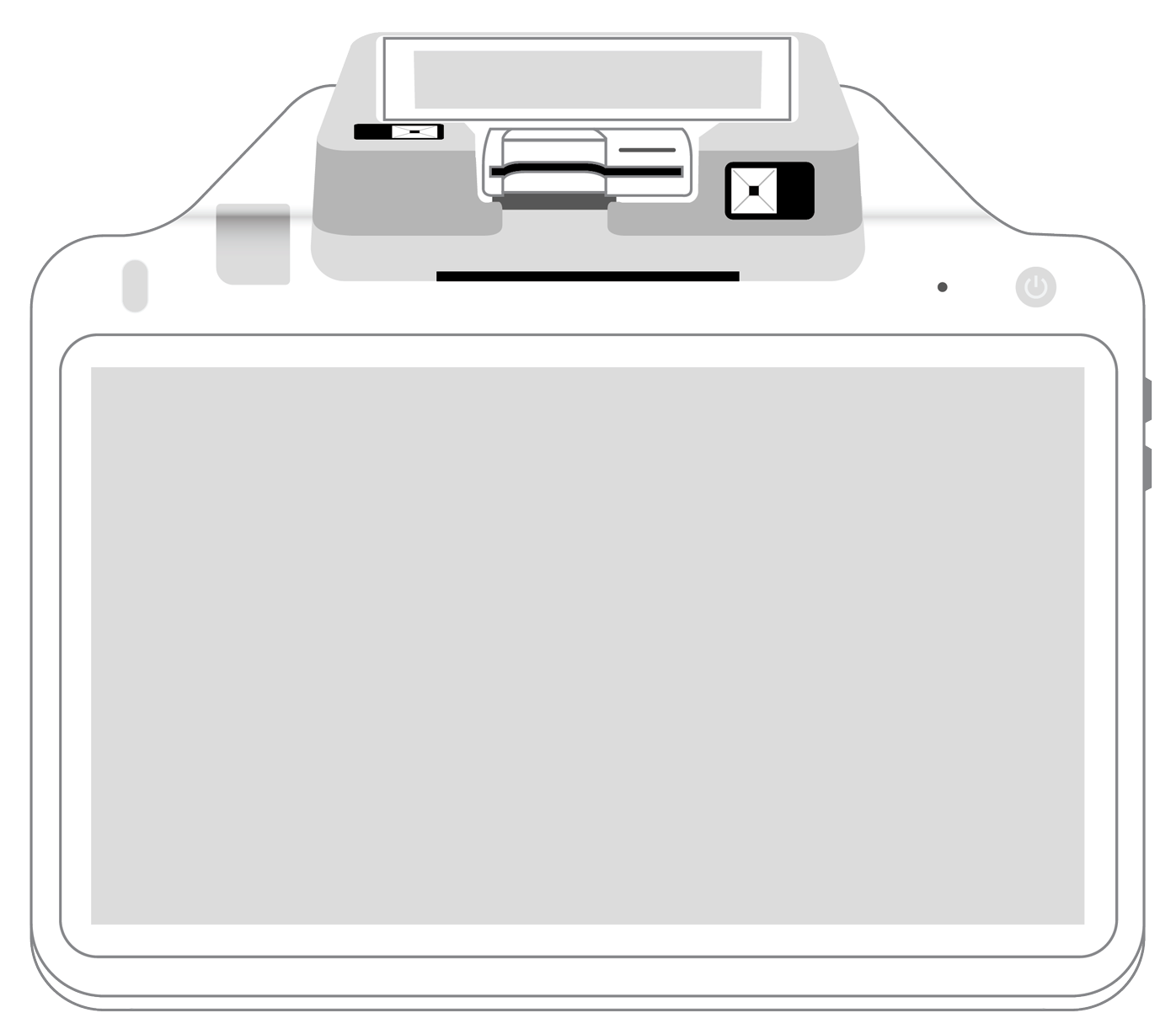

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||