Virtual terminals: how to select the best solution for payment management.

Is a virtual terminal the right payment management solution for your business? With a simple interface, mobile compatibility, and the option for additional features, this tool for accepting credit cards can benefit businesses in multiple industries. Here’s what you need to know to decide if a virtual payment terminal meets your needs so you can find the best option for serving your customers.

The basics of virtual terminals.

When you think of payment processing, you’re likely to picture a credit card reader, a point-of-sale (POS) terminal, or an online payment page. Virtual terminals don’t fit in any of these categories, although using one is similar to submitting an ecommerce payment. A virtual terminal requires no hardware and is hosted online to allow for mobile access wherever an internet connection is available. You can get one on its own and link it to your existing payment processor and merchant account, or choose a comprehensive payment solution providing a virtual terminal as an option.

Virtual terminals can be accessed on any device capable of connecting to the internet and are commonly used to process card-not-present transactions. A customer simply gives you their information and you key it in with the transaction details and submit it for processing. Virtual terminals equip your business to accept credit cards, debit cards, and echecks and should also have an option for recurring payments or subscription plans.

Some virtual terminal providers offer credit card swipers so that you don’t have to get a separate payment processing platform for card-present transactions. As payment solutions become more robust, it’s increasingly common to find platforms designed to fulfill a variety of business needs above and beyond processing.

Virtual terminals vs. payment gateways.

The rise of all-inclusive payment processing solutions has made the terminology surrounding merchant services, like virtual terminals, a bit murky. Services once thought of as distinct now come packaged together, which can create difficulties in understanding exactly what you need for your business.

Consider ecommerce. If a virtual terminal is similar to a checkout page, is it what you need in order to better serve your online customers? Not exactly. The form your customers use is powered by a payment gateway, the customer-facing platform for keyed-in transactions. When orders are submitted online, it’s the customer who inputs card data and billing information instead of the merchant.

Payment gateways are also involved in other types of payment processing, including the use of virtual terminals. In these instances, the terminal connects to the payment gateway. The payment gateway is then responsible for securely processing and transmitting transaction information for authorization. You don’t need a virtual terminal to set up a payment gateway, but some payment gateway providers do offer virtual terminals to give you more options for accepting payments.

Which businesses should use virtual terminals?

Virtual terminals don’t take long to set up and they provide both flexibility and diversity in payment processing. Because no special hardware is necessary, they’re inexpensive to implement and operate. Plus, the ability to access the terminal from anywhere (using any type of device) gives even the smallest businesses the ability to accept mobile payments. These features make virtual terminals useful for:

- Service-based businesses, particularly those offering field service.

- Businesses making the majority of their sales at offsite events.

- Home-based businesses.

- Businesses with low transaction volumes.

- Small companies without the budget for full-scale POS solutions.

- Taking orders my mail, fax or phone.

- Setting up payment plans.

- Billing for recurring services.

- Making sales while traveling.

- Online businesses with customers who may be wary of submitting credit card details through a website.

Basically, if card-not-present transactions are important to your bottom line, you should have a virtual payment terminal. You’ll never be without an option for taking payments, which can lead to new sales opportunities should you unexpectedly run into potential customers when you’re away from your principal place of business.

Essential virtual terminal features for small businesses.

If your business is a good fit for virtual terminal payment processing, you need a solution with the right mix of features to improve customer service and increase sales. Looking at features in the following six categories can help you make the right choice.

Price.

It’s typical to pay both a monthly fee and transaction fees when using a virtual terminal. Transaction fees are charged using the interchange-plus pricing model, which consists of a percentage of the total transaction amount and a small additional fee. Because card-not-present transactions have a higher potential for fraud, processing payments through a virtual terminal is a little more expensive than using a card reader. However, echeck processing tends to be cheaper, so you could save money if most of your customers use this as their primary payment type.

Pay attention to service agreements before signing up for a virtual terminal. You shouldn’t be required to sign a lengthy contract or subject to cancellation fees, but it’s smart to review all fee details in advance so that you know what your monthly bill will look like.

Ease of setup and access.

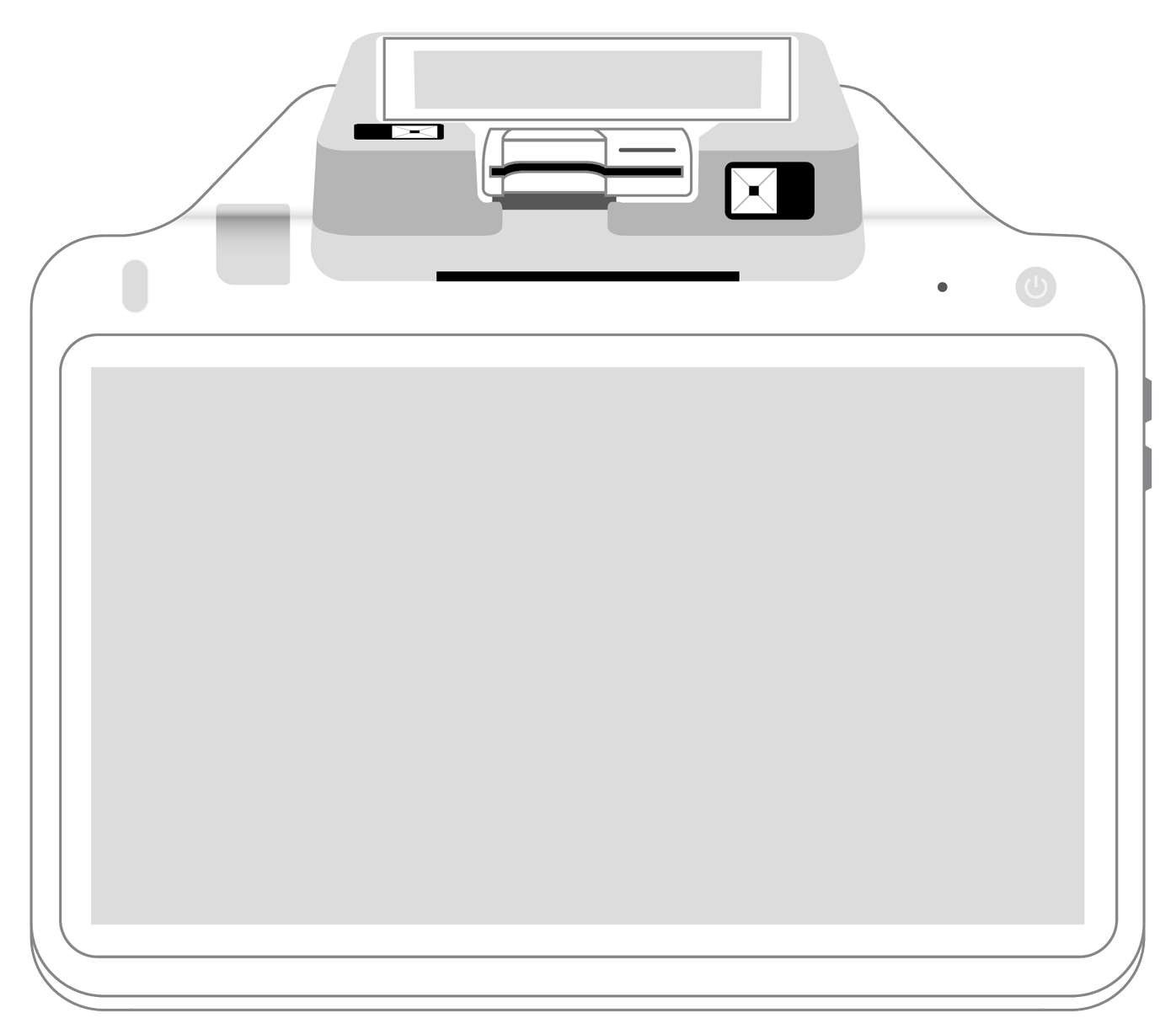

Your virtual terminal provider should offer a quick setup and a clean user interface compatible with multiple devices and operating systems. If a card swiper is available, make sure it works with the phone or tablet you plan to use as your primary machine for processing transactions. Intuitive functions are a must so that your employees can learn to operate the terminal without any trouble and you can start accepting new forms of payment as quickly as possible.

Ecommerce options.

If you want to sell online, check out virtual terminals with ecommerce integrations or ecommerce platforms offering built-in virtual terminals. A streamlined solution with all features in one place is often preferable unless you have a very small business and don’t require extensive ecommerce options. At the very least, your virtual terminal should:

- Accept all major credit cards, debit cards, and echecks.

- Have a customizable, user-friendly customer interface.

- Be easy to integrate with your current website.

- Allow for both one-time and recurring payments.

Keep future needs in mind to avoid limiting the potential of your online sales efforts. Virtual terminals with extensive integrations or add-on features are scalable and simplify expansion into online markets as your customer base grows.

Enhanced security.

To maintain compliance with PCI standards and minimize the risk of data theft, cardholder information needs to be shielded from malicious activity during every transaction. Virtual terminals don’t handle actual processing or transmission, but the option you choose needs to be compatible with a secure payment gateway or part of a complete solution in which secure processing is included.

The payment gateway should use encryption or tokenization to protect card data during transmission, and data stored for recurring transactions must also be protected. Access control measures, such as the ability to set permissions to manage employee access. Then, reduce problems with internal threats by ensuring data is only available to those who need it to do their jobs.

Data tracking and congruity.

If you have more than one store or take payments at multiple locations, using a virtual terminal ensures all the data winds up in the same place. For example, the sales your employees make at a trade show halfway across the country appear in the system in real time along with sales made in your store and online. Many virtual options also include tools for generating reports and analyzing data so that you can improve your marketing and customer service efforts.

Having a congruent database becomes essential as your business grows. Storing information from repeat customers expedites future purchases, making processing even faster and providing you with sales details you can use to craft targeted offers for bringing customers back.

Technical support.

From help with the setup to troubleshooting, if the system goes down, you need tech support you can count on. Check out different providers’ technical support options to find out how easy it is to get in touch with representatives, how fast problems are typically resolved, and whether or not someone is available 24/7.

You may discover a basic virtual terminal doesn’t cover everything you need. Should this be the case, you may want to consider a complete POS solution instead. Another option is to start with a virtual terminal provided by a company with a wider range of features, which you can add to as payment processing requirements continue to change.

Knowing what to look for in a virtual payment terminal simplifies the selection process and guides you to the smartest solution for your business. A feature-rich terminal diversifies payment options online and in person, frees customers to shop their way, and opens your business up to more sales opportunities. With quick setup and easy processing, your business could be on track for sustained and substantial growth.

More from Business tips

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||