Updating your payment system in 2020: what to look out for.

Your customers are looking for more flexibility and less friction in payments in 2020. Giving them what they want has the positive upshot of maximizing your company’s sales potential, improving your cash flow, and boosting profits.

How can you tap into the benefits being offered by more contemporary and flexible payment devices? Make these four updates to your payment system this year.

Leave legacy systems behind.

The payment process isn’t just about making sales. It’s a key part of the customer journey. If that journey is too complicated or takes too long, you’ll lose customers. An ideal payment system allows customers to choose from a range of payment options and enables fast, error-free checkout in store and online.

Legacy systems lack agility and may no longer have the support necessary to meet today’s data privacy and security standards, like PCI compliance for example. Many legacy systems also aren’t equipped to collect and analyze customer data, which makes creating smarter, more targeted ad campaigns difficult.

Remove payment information silos.

Siloed data is another major issue with legacy systems. If one payment processor doesn’t have a feature you need, you have to “stack” on another one. Consolidating payment processing into one point of sale solution solves the problem and provides detailed analysis tools to improve your marketing efforts.

Switch to digital invoicing.

Paper invoicing is a slow, error-prone process with a negative impact on cash flow. Between supplies, processing, and the time it takes customers to pay after receiving invoices, you’re looking at an average cost of $12 to $30 to complete one transaction.

Digital invoicing solutions automate invoice generation, payment reminders, and payment processing to reduce both costs and payment delays. Payment systems with integrated invoicing collect data from orders and paid invoices in one place to facilitate accurate accounting, a handy feature year-round but especially when it comes to tax season.

Prioritize mobile payments.

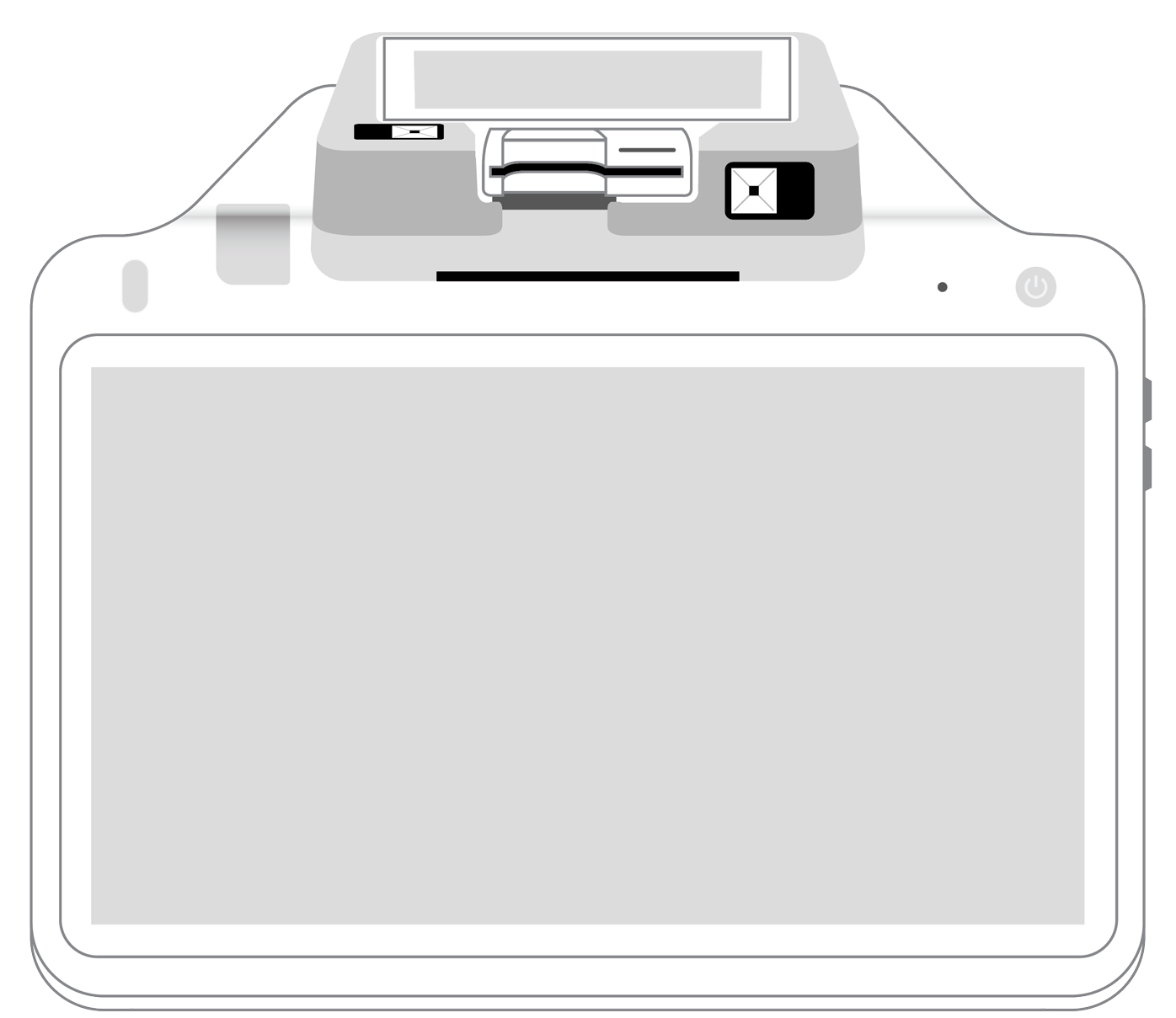

Customers are already using their phones to pay for purchases more often, so make 2020 the year you invest in an NFC contactless payment system. For additional flexibility, get a mobile card reader or virtual terminal.

Streamlining your payment process in 2020 gives your business the agility to respond to changes in consumer payment preferences. Position your business to grow by investing in a payment solution designed to accept multiple payments, while providing a seamless customer experience across all channels.

More from Business tips

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||