Top options for home businesses to accept credit cards.

Are you ready to start offering more payment options for customers who purchase from your home-based business? Try these methods for simple, convenient credit card processing!

Using virtual terminals.

Accessible from your computer or mobile device, a virtual terminal makes it possible to process credit card payments over the phone, by mail, or in-person without a credit card machine. Completing an order is as simple as logging in and entering customer payment information. If you take your home business on the road, add a mobile card reader to facilitate in-person transactions. Customers enjoy the convenience of digital receipts, and you benefit from a growing database of customer profiles and transaction histories.

Issuing invoices.

Technology is giving the old-school invoice a modern makeover. Thanks to updated payment systems, you can now generate and issue invoices entirely online! Create a cohesive customer experience with a custom-branded invoice design. Then, send completed invoices via email. When invoices arrive in customer inboxes, they’ll have the option to click a link or button and pay right away with the credit card of their choice.

Many invoicing programs also offer tools to automate payment reminders so that you don’t have to send emails or make calls every time a due date rolls around. To incentivize on-time payments, you can even add an early payment discount or late payment fees, which are automatically calculated when invoices go out.

Integrating and managing inventory.

Some payment platforms include inventory management tools along with virtual terminals and invoicing. That’s convenient if you make or resell physical goods as part of your home-based business. Simply create a convenient online catalog with custom categories and modifiers, and easily select items to add to orders when completing sales through your virtual terminal.

Sales data reveals what sells well and which products are slow movers. Use analytics and reporting within your payment platform to make adjustments to your offerings and sales strategies. When you stop wasting resources on inventory no one buys, you have more time to spend streamlining your business and boosting profits.

Recurring payments.

If you accept credit cards for your home business as payment for recurring or routine services, save time by automating invoice generation. Setting invoices to go out at the same time every month saves you the mad scramble of trying to handle manual invoicing for multiple customers and ensures customers get consistent service.

To reduce the chances of missed payments, offer an autopay option for those who prefer to “set and forget” their monthly bills. Customers set up payment using their preferred cards, and the amount is automatically charged on the due date to guarantee you always get paid on time.

Let customers know as soon as you’re set up to accept credit cards for your home business. Adding this convenient payment option lets you reach a wider audience and can encourage existing customers to make larger purchases. Get started with credit card processing. Then, get ready for growth as your business moves forward!

More from Business tips

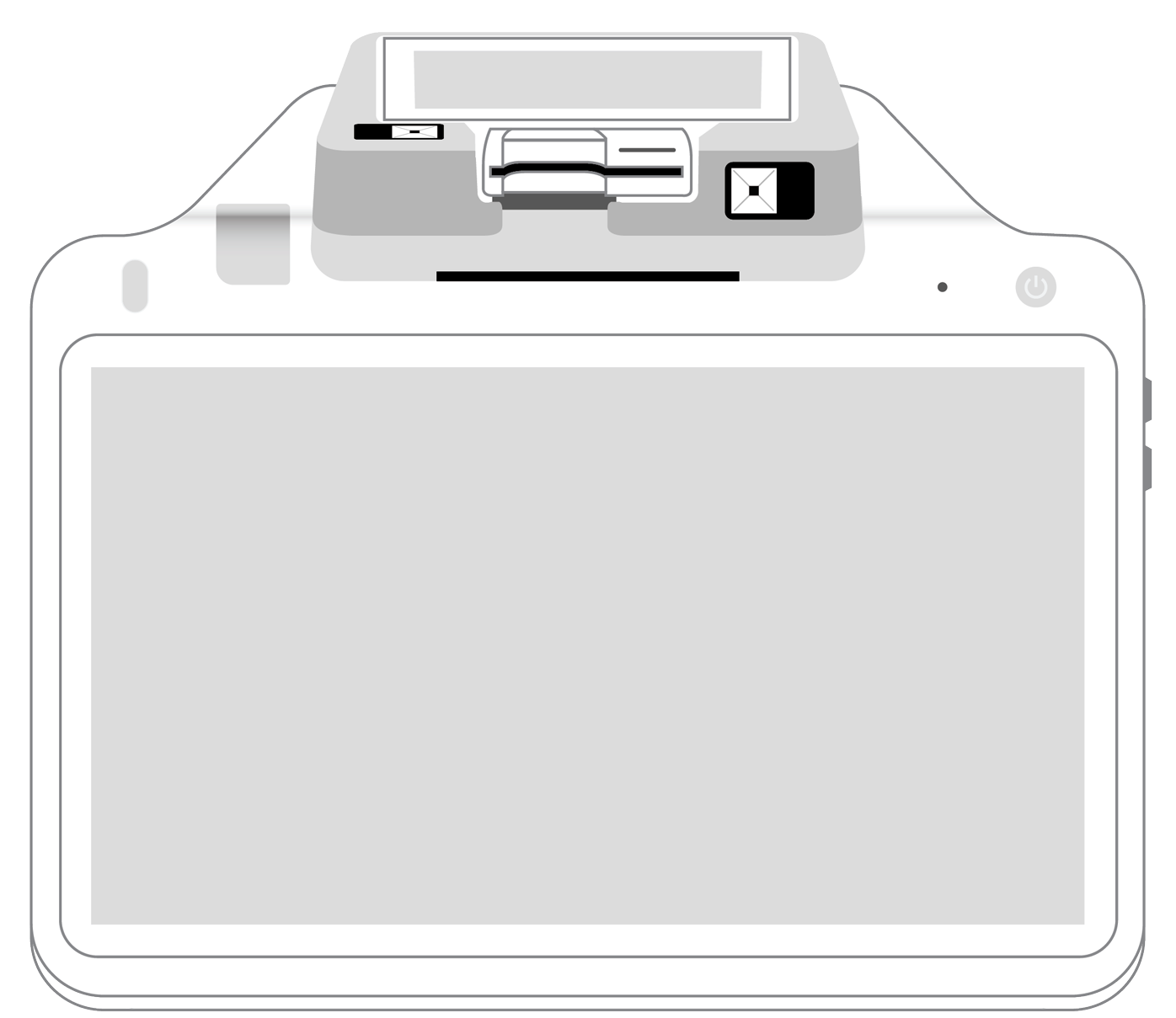

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||