The secret to getting invoices paid on time.

Customers who don’t pay invoices by the due date can cause a lot of grief for your business. Late payments interrupt cash flow and reconciling delinquent accounts wastes valuable time. To manage your invoices and ensure prompt payment, you need the right tools, terms, and follow-up strategies.

Choose your invoicing platform.

Managing invoices by hand becomes overwhelming as soon as your business starts to grow. It’s easy to fall behind when you have to keep on top of creating and sending invoices, checking due dates, and issuing payment reminders, while simultaneously managing your day-to-day operations. You may not even know you have unpaid invoices until weeks after the due dates pass.

Invoicing software consolidates invoicing, payments, and tracking into one platform. Look for a solution designed to integrate with your accounting software to keep payment data current across systems with real-time updates. Once the software is set up, you should be able to send invoices promptly and review outstanding payments at a glance.

Your invoicing solution should also:

- Allow for customization, such as the addition of branding.

- Save customer data for future invoices.

- Store typical payment terms, including discounts and fees.

- Send automated payment reminders.

- Provide a clear overview of customer payment histories.

- Make it easy to review the products and services delivered to customers.

- Include reporting tools for financial information and payment data.

- Incorporate shipping, tax, and delivery fee information into invoices.

- Use strong security to protect sensitive customer data.

These features drastically reduce the amount of time you will spend on invoicing and increase the likelihood of customers paying when you want them to.

Set your invoice terms.

Terms should be discussed upfront so that customers aren’t confused or surprised by the final price when you send your invoices. Use the time prior to beginning a project to establish strong relationships and to get an idea of what you can expect when working with each customer. If you’re ever in doubt about someone’s reliability, don’t hesitate to run a credit check. Doing so can help you avoid flaky customers and save you the hassle of chasing down late payments.

After the initial discussion, establish the terms of sale for the job. These should include:

- The sale total.

- The date you’ll send invoices.

- Additional charges for shipping or delivery.

- Detailed payment terms.

Choosing the terms of an invoice isn’t always a straightforward process. You have to take into account your industry and the type of project, your relationship with the customer, and your knowledge of his or her payment history. Some common types of invoice repayment include:

- Net 30 – This means that payment is required within 30 days of the invoice date. Note that shorter or longer terms may be appropriate depending on job type.

- Month Following Invoice (MFI) – This establishes that payment is due on a specified date the month after the invoice is issued

- End of Month (EOM) – This means payment must be received by the end of the month.

- Upon Receipt – Under this arrangement, payment must be made when the invoice is received.

- Immediate Payment – This specifies that payment is due when goods or services are delivered.

- Payment in Advance (PIA) – With this type of invoice, a specified percentage (typically 30 to 50%) of the final total is due prior to starting a job or project.

You may want to consider offering a small discount to customers who pay before the due date. For example, if you choose Net 30 terms, you could reduce the total by 2% if a customer pays within 15 days, indicated by “2/15 Net 30” on the invoice. You’re free to set whatever discount level and early payment window you choose, but be careful not to slash the price to the point where you start suffering losses.

You can also shorten your net terms. A study by Xero showed businesses sticking to shorter payment terms get paid sooner than those giving customers a longer period of time to pay. Customers paid by day 18 on average when issued invoices with 14-day terms, whereas those issued 28-day invoices paid on time, but not until the last minute. However, in some industries, customers expect to have a full month to review your work and get finances in order before paying.

The best terms will balance your need for reliable cash flow with your customer payment patterns and financial situations. You don’t want to wind up strapped for cash just days before your own bills are due and get thrown off when customers fail to meet payment deadlines. It also doesn’t make sense to put customers in a bind with unreasonably short invoice terms.

How to word invoices for prompt payment.

Hitting a “sweet spot” with your terms doesn’t guarantee you’ll get paid on time. Statistics show businesses wait more than 60 days for payment on 62 percent of invoices and only six percent of invoices are paid in under 30 days. However, increasing timely payments can be as simple as changing the way you word your invoices.

According to FreshBooks, companies using “please” and “thank you” on invoices see five percent more payments than those employing more businesslike language. Customers are also more likely to pay before due dates when you use familiar phrasing, such as “30 days” instead of “Net 30.” Highlighting your early payment discount in bold type offers even more of an incentive by letting customers see right away how much they can save.

To avoid any confusion, layout your invoice in a clear and understandable way. State the price you quoted at the start of the project, while being sure to itemize all charges. Include an invoice number and place the terms and due date in a prominent spot where they can’t be missed or overlooked.

Best options for payment processing.

When it comes time to pay, customers look for the most convenient options. Writing a check may once have been the standard, but now it’s an extra step many people would rather skip. Your invoicing software should include tools for accepting multiple payment types, including credit cards and third-party payment platforms such as Apple Pay.

Credit cards are the top choice for most customers and many also have accounts with popular online or mobile payment services. Offering numerous choices increases your chances of getting paid on time because customers don’t have to go out of their way to use payment types they’re not used to or just plain don’t like. Automatic payments for recurring services are even easier and ensure you get your money even if customers forget the dates their bills are due.

Choose a flexible payment processing solution based on the preferences of your giving you the option to add more payment types later as your business grows or new payment technology becomes available. It’s smart to continue accepting cash and checks as well, since some customers still prefer these methods. Just be sure to record paid invoices in your accounting platform to keep your books current and accurate.

What if customers still pay late?

You will inevitably have customers who miss their invoice due dates. Some people forget, some hit rough spots financially, and some just hope you won’t notice. Setting up automatic payment reminders to go out a few days before payments are due and again on the due date can help, as can re-sending the invoice with a polite note the day after it’s due.

If customers ignore or miss these messages, give them a more personal reminder over the phone. Find out what’s delaying payment and if there’s anything you can do to make it easier for the customer to get your money to you. Be willing to work with long-term customers who have rarely or never missed payments before, but keep exceptions reasonable. If customers still don’t pay, you may have to get in touch with a collection agency.

The jury is still out on whether charging late fees increases on-time payments. If you choose to implement a fee, include the details in your terms. It’s common for businesses to charge 1.5 percent for each month past the invoice due date. You can automatically add this amount to late invoices in your accounting program. Enforcing late fees may feel uncomfortable, but you can’t let customers continue to delay payments until it starts to hurt your bottom line.

The occasional late payment probably won’t tank your business, but a string of unpaid invoices can leave you struggling to meet your own expenses. You work hard to deliver products and services to your customers and you shouldn’t have to wait until the last minute to get compensated.

Since the success of your business depends on consistent cash flow, make the invoicing and payment process as easy as possible for yourself and your customers. Be clear about your terms from the start, maintain good relationships, and always take advantage of automation to keep up with invoicing and encourage customers to settle up with you on time, every time.

More from Business tips

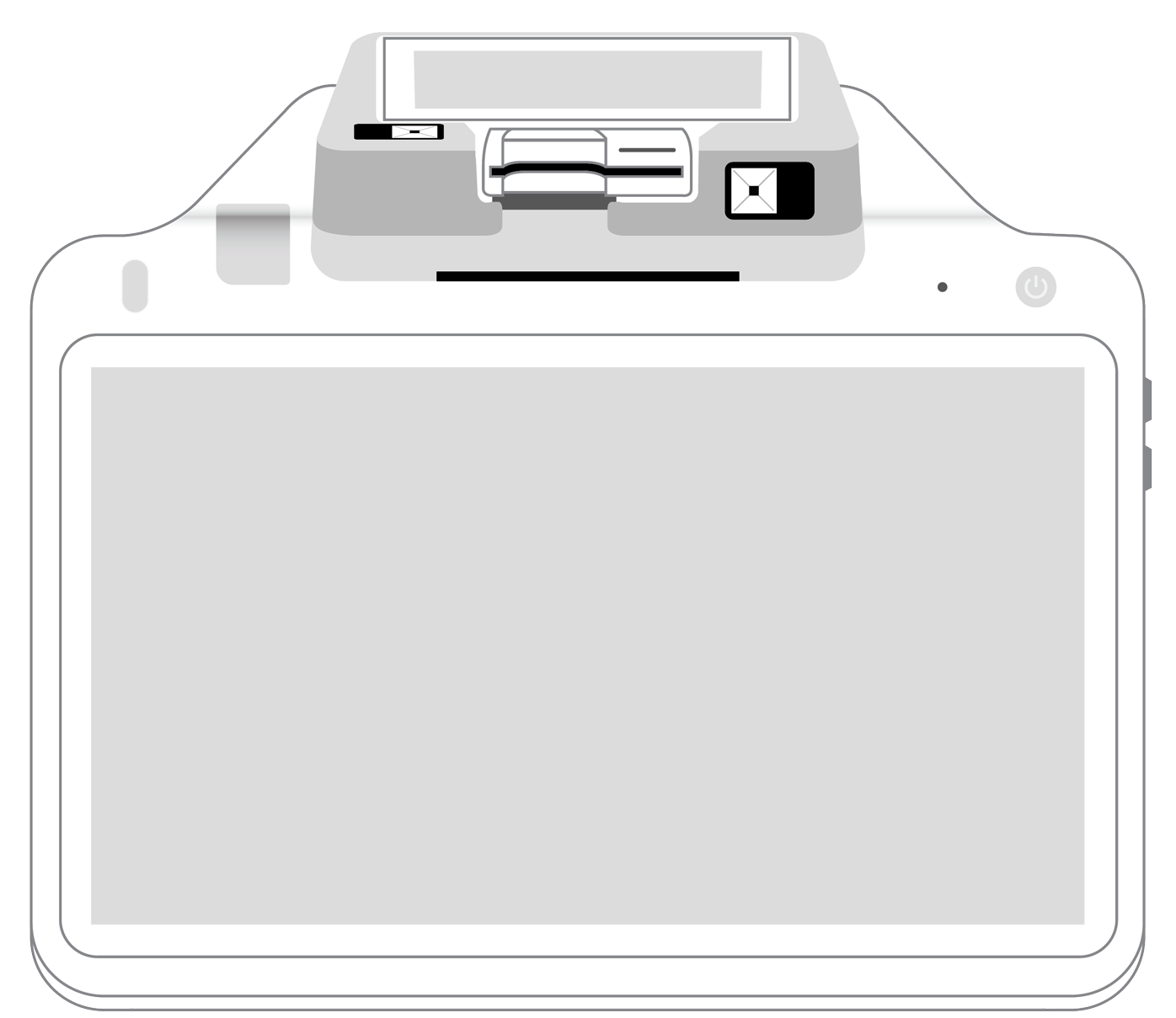

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||