Payroll Tips for Small Businesses

As an entrepreneur, you need to pay close attention to your payroll for a number of reasons. As YFS Magazine recently stated, "Small and medium-sized businesses spend more to handle payroll associated tasks compared to larger businesses; specifically in-house administration of payroll, workforce administration, time and attendance, and health and welfare requires a surprisingly large commitment of time and resources."

Want to ensure a cost-effective and stress-free payroll process? Follow these seven tips and you'll be well on your way to relieving your payroll headaches:

1.) Accurately classify employees.

One of the most common mistakes made during the preparation of payroll is not having each employee classified properly according to their pay, benefits and tax status, so getting your employee classifications right will save you a lot of grief.

2.) Double-check your data.

Data entry mistakes such as entering incorrect hourly wages or hours worked tend to cost companies millions annually. In addition to lost revenue, data entry mistakes of this nature can even lead to government penalties.

3.) Stay up-to-date on labor regulations.

Tax tables and regulations governing payroll are constantly in flux. Not knowing about an IRS change or a new labor regulation can cost you both time and money when you have to go back and fix it.

4.) Leverage technology, but don't rely on it completely.

While the use of a payroll software package can help eliminate human error as well as save time, payroll software is only as good as your input, so be sure to provide accurate and complete information.

5.) Handle paperwork in a timely manner.

Distributing 1099 forms and other tax documents in a timely manner will save you a lot of hassles later. Despite the advantages of electronic filing and processing, paperwork remains an important part of payroll office activity. Don't let it bog you down.

6.) Put a stop to employee theft and fraud.

Sad but true: a small fraction of today's workforce are going to participate in practices like intentionally inflating their hours, extending breaks, engaging in activities unrelated to work while on the clock and even conspiring with other workers to exaggerate productivity. Paying extra scrutiny to payroll and enacting policies that discourage theft and fraud can save you a significant amount of time and money.

7.) Calculate overtime accurately.

Since overtime results in a higher pay scale, it's important to your bottom line to avoid paying for any more overtime than necessary. That means having a system that clearly defines what overtime entails, when overtime is authorized and how overtime is verified.

Want to view the original post? Click here.

More from News

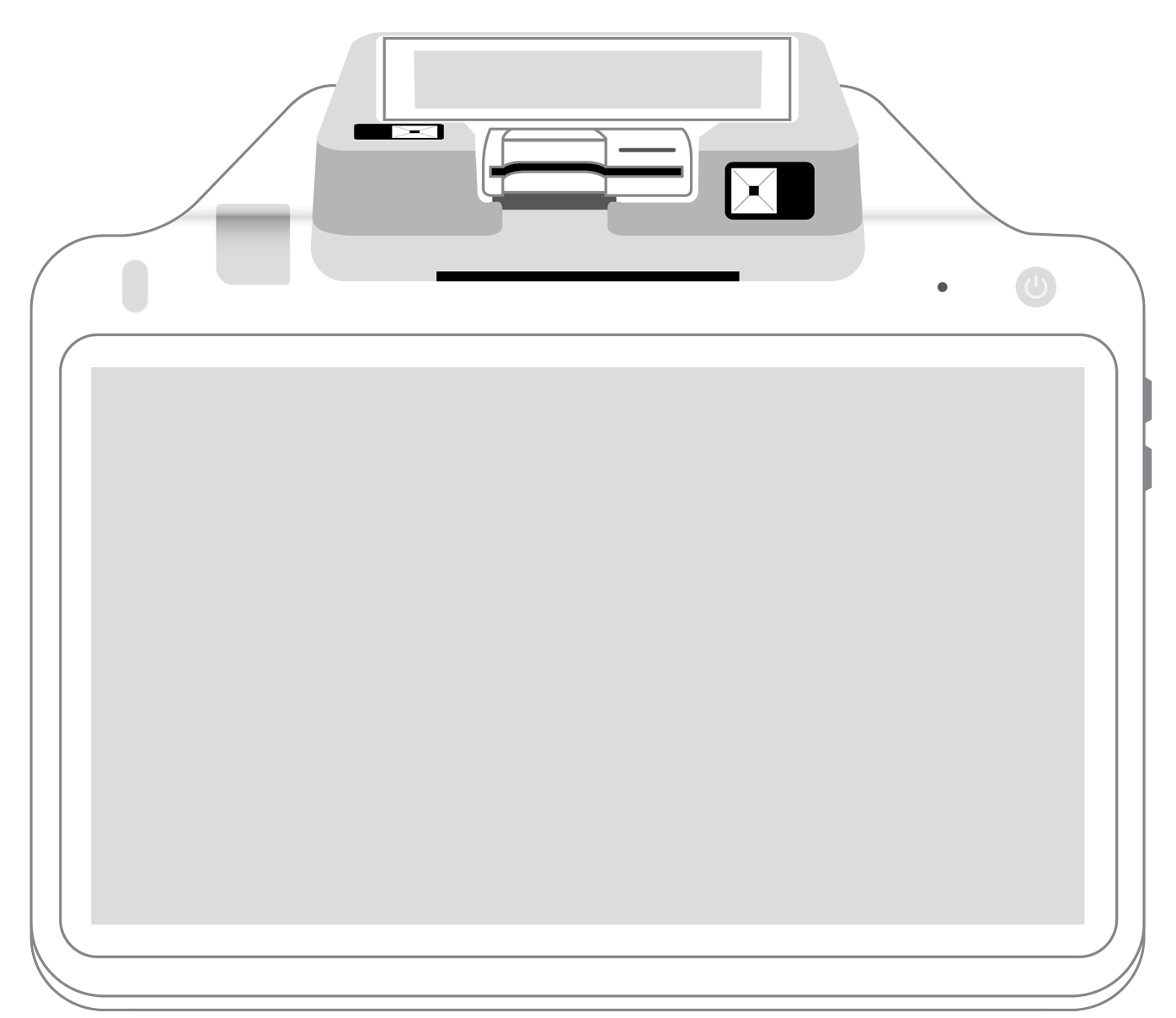

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||