Payanywhere: upgrading your businesses for a more secure 2020.

When it comes to the security of your business, we know you have a lot at stake. It’s not just your hard-earned money, it’s also your credibility as a business owner, and the passion you’ve poured into your business. All are valuable, and deserve to be protected.

Threats to businesses are constantly changing, and it can be tough to keep up with everything as a small business owner. At Payanywhere, we want to make sure your business is as safe as possible, which is why we’re upgrading merchants that are currently using the Payanywhere Magstripe Reader to accept credit and debit cards.

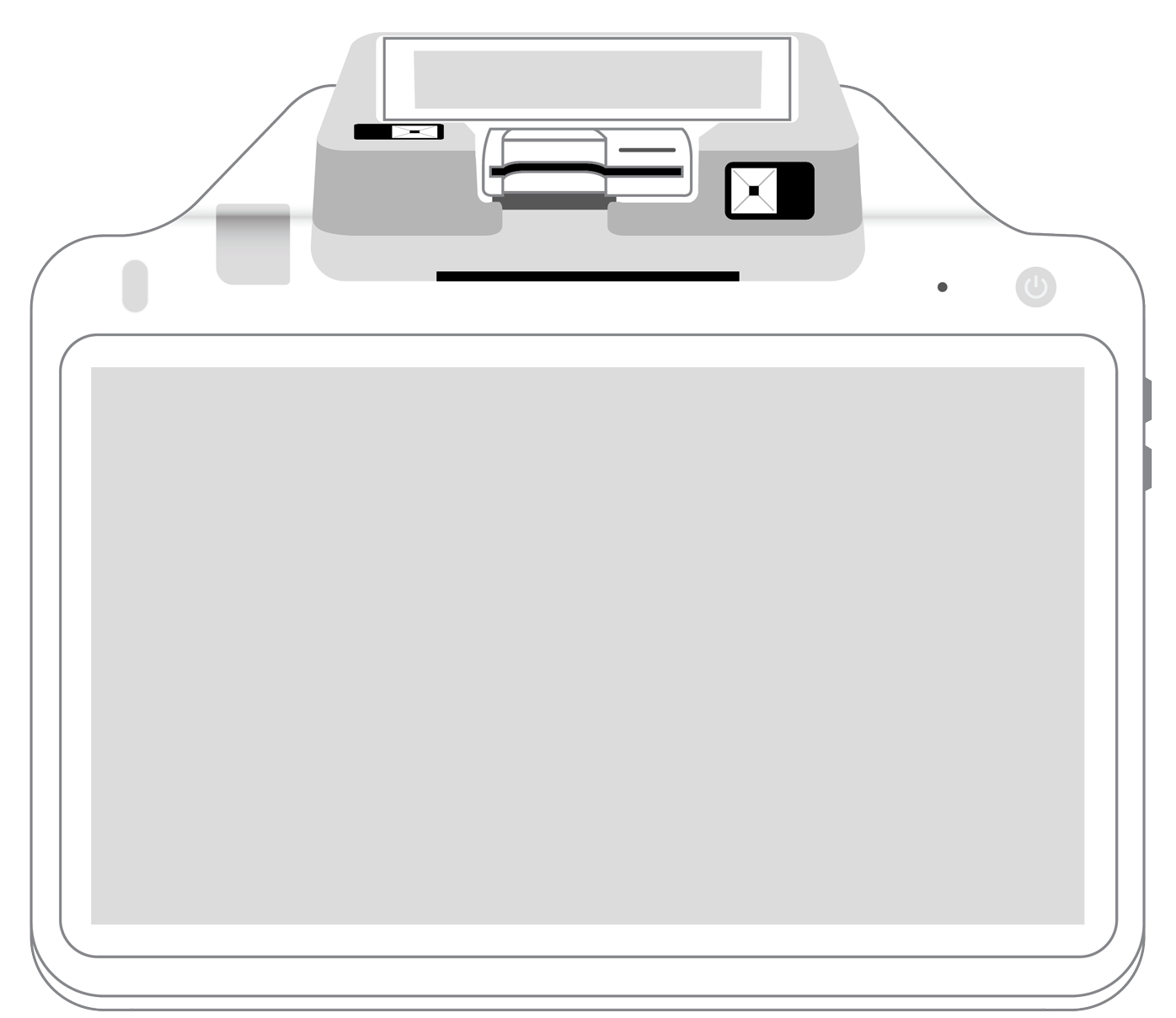

If you are one of these merchants, you will need to upgrade to the Payanywhere 2-in-1 Bluetooth Credit Card Reader or the Payanywhere 3-in-1 Bluetooth Credit Card Reader. Additionally, effective January 30, 2020, the Payanywhere Magstripe Credit Card Reader will no longer be supported.

We are requiring the upgrade to further our mission of providing safe and secure credit card transactions for all of our merchants. As a result, we are taking steps to outfit all of our merchants with hardware to accept EMV chip card transactions. This will be the most secure and compliant card transactions for you and your customers!

If you’re a merchant already using the Payanywhere 2-in-1 or 3-in-1 Bluetooth Credit Card Readers, you don’t need to do anything. The upgrade requirement only impacts merchants using the Payanywhere Magstripe Credit Card Reader.

The EMV upgrade.

Today’s small businesses don’t have all the resources large enterprise organizations have, so it can be challenging to include all of the best security practices when accepting credit cards. By upgrading to the Payanywhere 2-in-1 Bluetooth Credit Card Reader, or the Payanywhere 3-in-1 Bluetooth Credit Card Reader, you are getting built-in protection by using an EMV-enabled card reader that is equipped with the extra level of security you need to run compliant card transactions. It is a cost-effective action you can take that goes a long way to help ensure your business and private cardholder data are protected.

EMV security benefits.

By using the Payanywhere 2-in-1 or 3-in-1 Bluetooth Credit Card Readers, you will be able to accept payments with EMV chip-enabled cards – which is a much safer transaction than the traditional magstripe card transaction. Some of the security features of using EMV chip cards include:

- Sophisticated encryption – When your customers use an EMV chip-enabled credit or debit card, the security is built directly into the card. And, when you’re using an EMV-enabled reader - like a Payanywhere 2-in-1 or 3-in-1 Credit Card Reader - the transaction becomes encrypted as soon as the transaction takes place.

- EMV helps prevent fraud – Using EMV cards and readers to accept them is a practice designed to help prevent the incidence of fraudulent transactions.

- Difficult to clone – Different than their magstripe counterparts, EMV cards are much more difficult to steal information from. The data on chip cards is constantly changing and very difficult to isolate for extraction.

Protecting you and your customers.

Today’s consumers are educated about the new forms of payment, like EMV transactions and NFC payments. By being able to accept an EMV chip-enabled card, you’re tailoring your business to the preferred payment methods of consumers, and will be able to better support your customer’s evolving payment demands.

Your business is important to us, so we want to ensure all our merchants are as secure as possible. Being equipped with a card reader that can accept EMV transactions will ensure your business can now protect itself and customer data by using this preferred - and compliant - payment type.

If you have questions about this upgrade and what it means to your business, please contact us at 866-485-8999 or custservice@payanywhere.com and we’ll be happy to help you.

More from News

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||