Multi-Account Smart Cards – Are They Worth It?

For some reason, we like devices that control a multitude of things, like the universal remote control, that combines cable box controls with DVD players, gaming consoles, etc. The most recent entry into this category are virtual home assistants, like Amazon’s Alexa Voice Service, that can control many functions and appliances within your home, like your thermostat, lights, garage door, in addition to play music and give you the news, sports and weather reports. This multi-function control idea has extended to payment cards, with universal payment cards that are aimed at decluttering your wallet while maintaining an aspect of familiarity with credit cards.

Universal payment cards are credit-card sized electronic devices that allow customers to load the information for debit, credit and loyalty cards on one piece of plastic, offering convenience and added security over standard credit cards, for a price. Some will even take gym membership cards. As long as it has a magnetic stripe, it can be loaded on to a universal card.

Some people may think, wait a minute – isn’t all of that what mobile payments are supposed to do? The answer would be yes. However, despite the recent advances in mobile payments, the smartphone-based wallet system is still only accepted in 2.4 percent of the nine million U.S. stores that accept credit and debit cards, whereas because they function like a credit card, smart cards are accepted in 100 percent of credit and debit card-accepting stores.

At their most basic level, the all-in-one cards – often called “smart cards” – function just like a regular credit card, except they carry the information of several cards. They usually have their own smartphone app that acts like a remote control for the smart card, letting you manage the accounts you’ve synced to the cards, and even disable the card entirely if necessary. As an added security measure, the cards will actually lock themselves if they get too far away from your smartphone, so if you lost your smart card or accidentally left it behind in a store, it would not work. And because your credit card information is not printed on the card, there is nothing to steal, rendering the card useless in the hands of a thief.

However, these smart cards do have some issues, the first being that they usually charge fees that are fairly equal to membership fees of some prestigious credit cards. There is also the confusion that the smart cards can cause in a retail or restaurant setting. As many people are unfamiliar with them, the plain, usually black pieces of plastic don’t look like typical credit cards – there is no imprinted information, no signature, no EMV chip and no credit card company hologram on the cards. The cards are not yet widespread enough to not garner curious looks and unwarranted questions from retail employees, or for a waiter to tell a restaurant patron that the card cannot be accepted. This social awkwardness has prompted some early adopters to stop using the cards.

Despite their flaws and relative obscurity, if more people were to know about them, smart cards might actually be a good bridge between traditional credit cards and mobile wallets. The smart cards have all the familiarity of a credit card, in terms of size, shape and function, with the added bonus of storing several credit cards and loyalty cards on it, like a mobile wallet. Some even include NFC capabilities, so they can help customers get used to the “tap and pay” aspect of a mobile wallet. If you are considering a smart card, as with any other gadget, you must compare each card’s cost and features. The right one for you may depend on how many cards you want to load on to the smart card and what kind of fee structure you’re willing to accept (one-time fee vs. subscription). Regardless of which one you choose, your wallet will be thinner – not from lack of cash, but from lack of plastic.

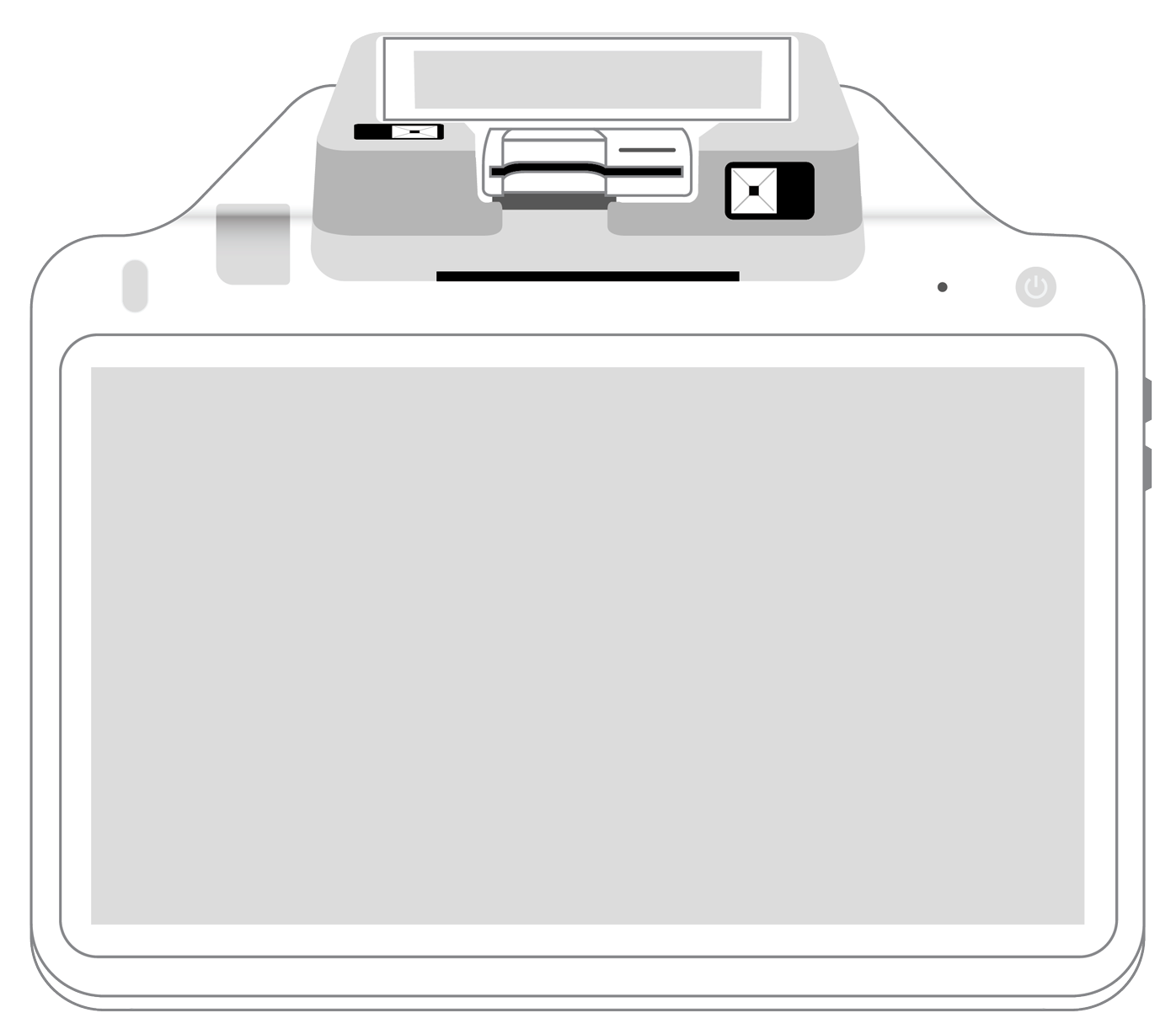

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||