The 5 Biggest Myths About Mobile Credit Card Processing

News

PayAnywhere

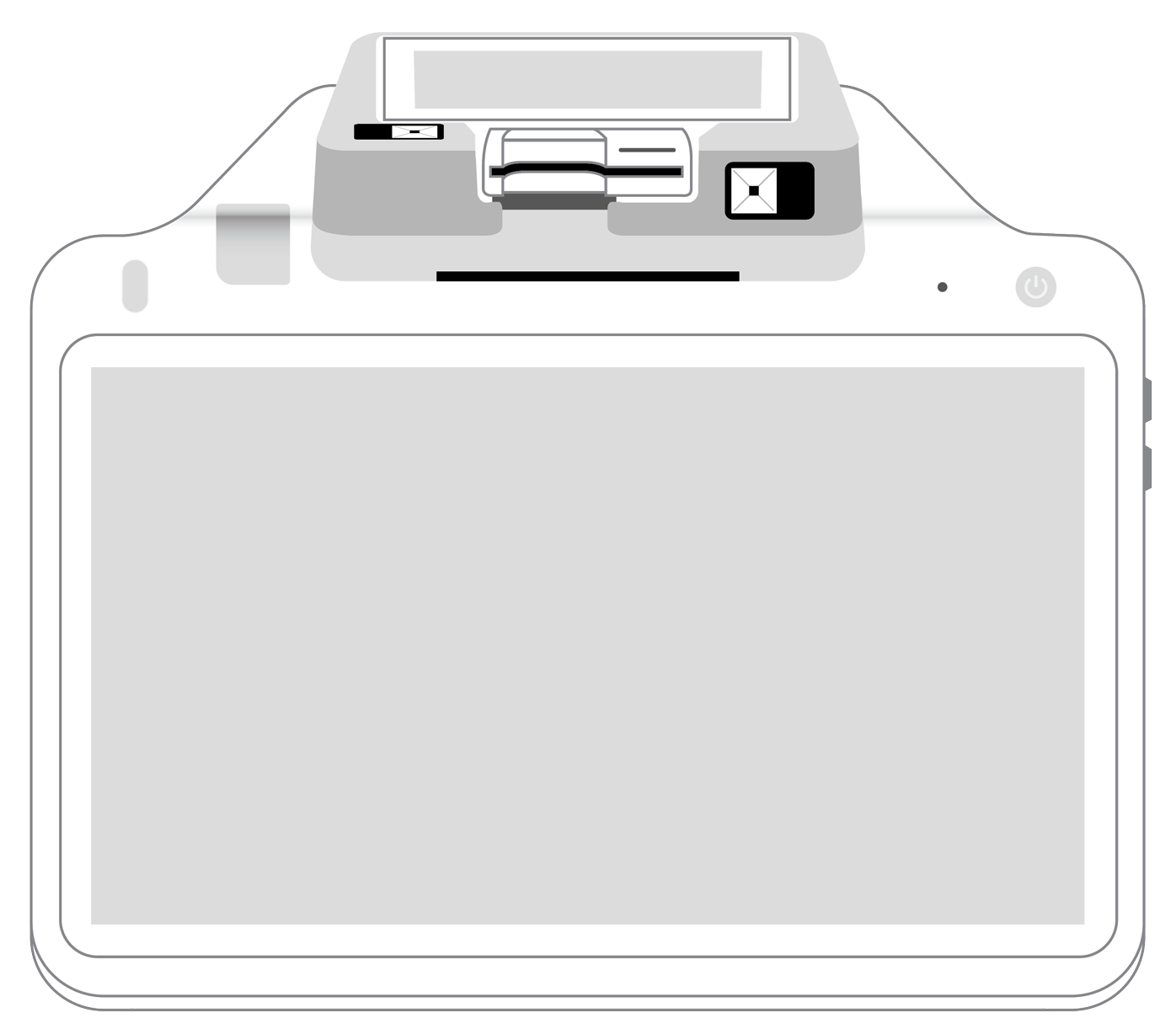

PayAnywhere Mobile allows you to accept Visa, MasterCard, American Express, Discover and PayPal on the go. Mobile credit card processing will give your business a way to accept credit card payments that is both easy and secure to use… or is it?

PayAnywhere Mobile allows you to accept Visa, MasterCard, American Express, Discover and PayPal on the go. Mobile credit card processing will give your business a way to accept credit card payments that is both easy and secure to use… or is it?

There are some myths about mobile credit card processing that we want to debunk. We hope the information in this blog will be helpful and something that you can share with your customers to put their mind at ease about using a mobile credit card reader.

- It’s just another credit card processing system, why do I need it?

The publication businessnewsdaily.com say that mobile credit card processing offers more flexibility in reaching your customer than ever before. Salespeople don’t have to be tethered to the cash register or counter credit card terminal any longer. The added functionality will lead to added sales because your staff can go where your customers are, and there is no need for those patrons to wait in a long register line. - The set-up is difficult.

Credit card processors don’t want to make things difficult for their merchants, and some have taken great strides to making it as intuitive as possible. In fact, PayAnywhere Mobile’s credit card reader transforms your Apple or Android smartphone or tablet into a mobile credit card reader. We’ve built PayAnywhere off something that you are already comfortable with and used to using, your smartphone, and just added the ability for you to take mobile payments for your business. - It’s expensive to process with a mobile credit card reader.

The fees for PayAnywhere Mobile is just 2.69% per swipe, including American Express! Factor in no setup, monthly, or hidden fees and this form of payment is very reasonable. And unlike some direct competitors, PayAnywhere Mobile offers next day funding, meaning you’ll get your money in your account quicker and keep your business running on all cylinders. - It raises the risk of fraud.

Actually the risk of fraud is decreased according to businessnewsdaily.com because data isn’t stored on the device, but rather it is stored on servers. This means that even if you lose your smartphone or tablet that your data, and your customer’s payment information, is secure. - The support system isn’t there.

Like any credit card processing device, mobile solutions are backed by the same stringent requirements as any transaction. Many companies, like PayAnywhere, have dedicated staff to handle any questions from merchants who use one of their mobile credit card readers. PayAnywhere Mobile offers merchants technical support by phone, email and chat to handle any issues that may arise when using their mobile credit card reader.

For additional information on how PayAnywhere Mobile can help your business, please visit our website or call us at (877) 387-5640.

Related Reading

Start your Payanywhere account.

Start your Payanywhere account.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||