Managing your cash flow during a crisis.

As a savvy entrepreneur, you likely went into business fully aware that sooner or later, unforeseen events would occur that could rock the very foundation of your company. However, even Nostradamus would have been hard put to predict the wrecking ball that is COVID-19. As you fight to protect your retail establishment during these unprecedented times, it is essential to recognize that being a good steward of your cash flow is your best defense.

Map your cash flow projections.

Think about it this way: You might as well do something productive with the time you once spent serving customers. So why not use any extra time you have now to write out a 13-week cash flow forecast containing a weekly description of the money you expect to gain and lose. Armed with this tool, you will be in a much better position to predict your future needs.

Revamp your collections process.

In the past, being generous with customers who failed to pay on time may have been fine. It might have even helped you to feel good about yourself as a human being. However, given the current climate, you may not be able to enable fiscal slackers anymore.

Offer benefits to early payers.

Along the same lines, incentives are often more effective than punishments. Therefore, reward people who pay early with discounts. At the same time, be sure that your payment terms are clear and that you take time to remind delinquent payers that they owe you with a friendly email nudge or a phone call.

Refine your inventory management.

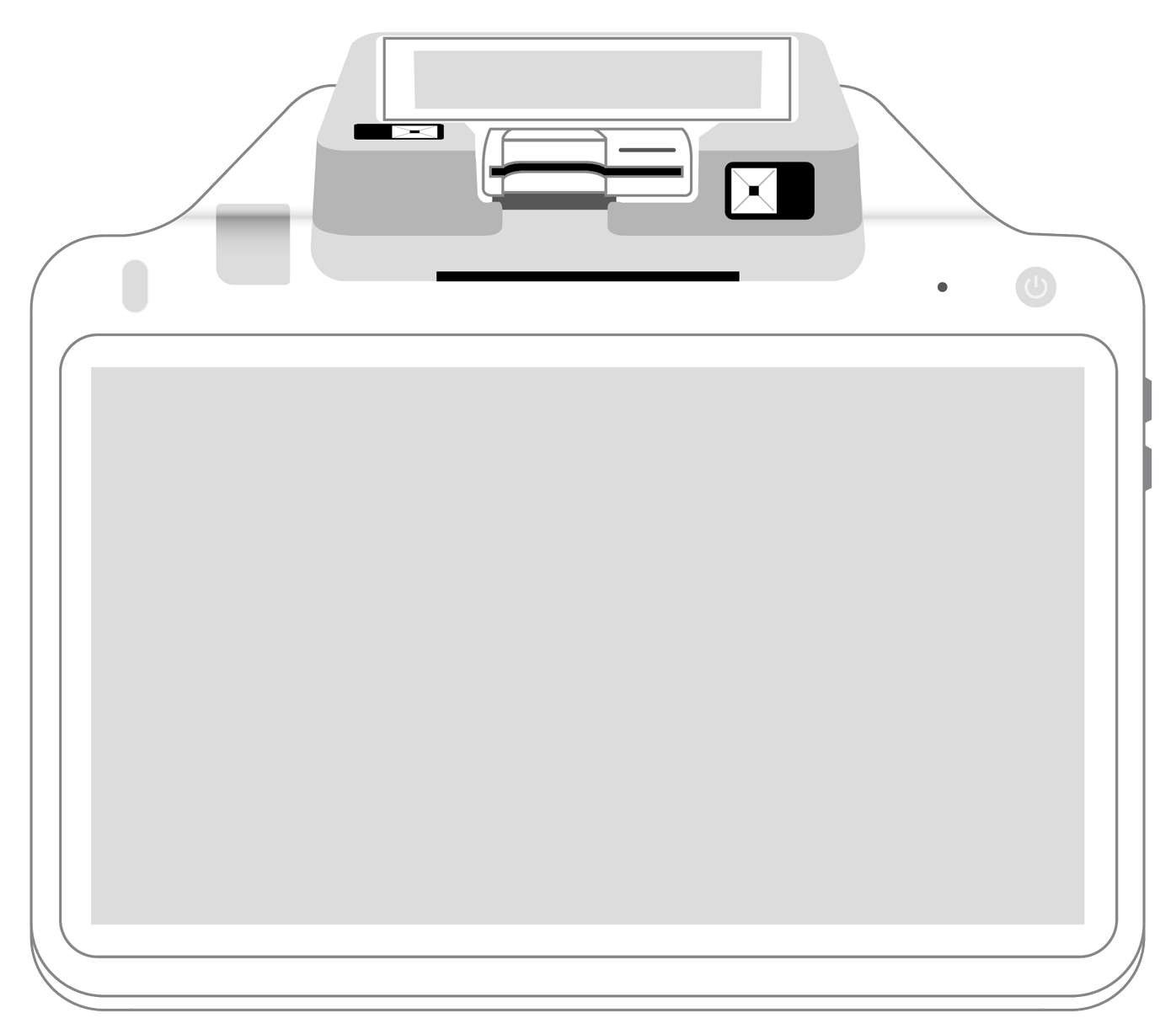

Your payment processing equipment probably does a fine job of tracking your stock, but you might not be using its capabilities to the fullest. Take the time to generate reports that show what is selling and what is not, and see if there is any inventory that you can reduce, without denying customers the products that they want.

Review contracts and agreements.

If you regularly work with vendors, you probably have ongoing relationships with them, some in the form of written contracts. Take a long look at these documents to learn if any of their conditions can be modified or eliminated. Remember that being transparent with your valued partners is always the best policy.

Modify your long-term strategic plan.

Before the current crisis hit, you may have had plans for expansion, equipment upgrades, new products, and so forth. Having said that, this is probably not the time to stretch your resources any thinner. For that reason, spend some time reviewing your plans. Put off what can be delayed, and modify or scale back what cannot be canceled entirely.

Most of us would agree that 2020 is a year which we will be happy to bid farewell to. However, the silver lining to this cloud is that you are not as powerless as it may seem. Instituting the steps mentioned above can help you to restore control of the all-important cash flow that will safeguard your business until we regain some semblance of normalcy.

More from Business tips

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||