Is your business equipped to accept the fastest payment methods?

Customers appreciate convenience and offering more payment methods is an easy and effective way to oblige them. Make checkouts more user-friendly with these three payment methods.

Automated clearing house (ACH) transfers.

Accepting payments via ACH isn’t new, however recent technological advancements have streamlined the process for both businesses and customers. You probably pay online using ACH without even realizing it. Any time a purchase is made using bank account information saved on a service like PayPal, the transfer is completed through an ACH.

So, why is ACH a top payment method for customer convenience? For starters, it provides a way for anyone to buy products on your website or place orders to be picked up at your store, even if they don’t have a credit card. Some point-of-sale (POS) system providers even integrate an ACH option directly into their solutions, so you don’t need to set up an extra service or credit card payment app to process payments. A customer simply has to put in their bank account number and routing information or use a linked service to pay for orders.

Mobile wallets.

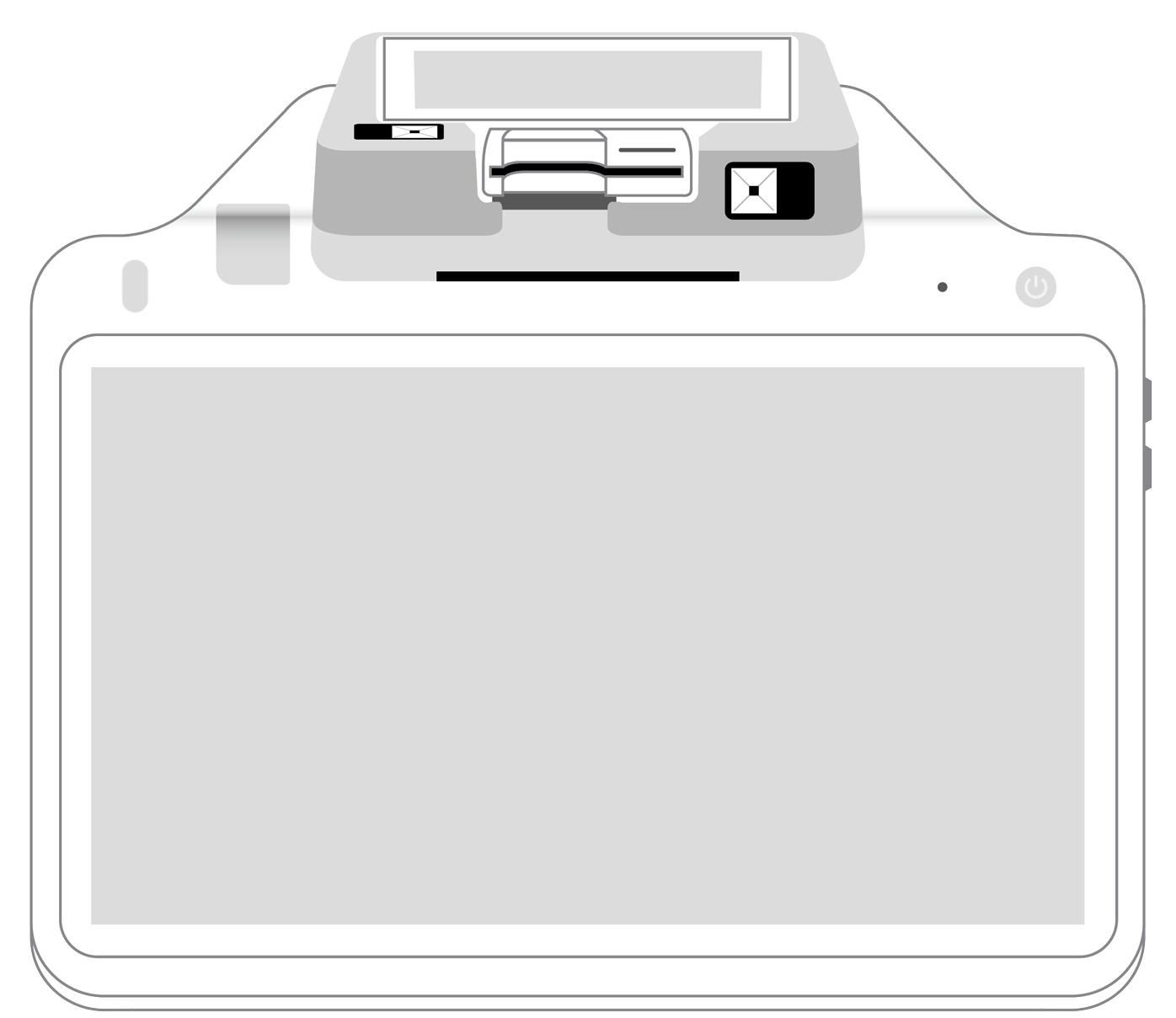

Most smartphones and some wearables come equipped with near-field communication (NFC) technology, which only requires customers to hold their devices near a POS terminal to complete a transaction. Payment information is stored in a digital “wallet” on the device. Apple, Android, and Samsung each have their own versions of wallets for NFC contactless payments made via phones and wearables.

Mobile payments are popular among millennials and Generation Z but are also seeing growing adoption in other demographics as older consumers begin to embrace more technology. You can get mobile readers from most major POS providers and although they may cost a little more than standard card readers, the investment should pay off as mobile payments are expected to rise to $503 billion by 2020.

Contactless cards.

It may not be long before your customers start asking for similar technology for “tap and go” payments with their credit cards. Contactless cards, which work using either NFC contactless or radio-frequency identification (RFID) technology, are becoming more popular in places like the U.K., where use has grown 44% since last year. Adoption is slower in the U.S., with only 3% of cards currently equipped for contactless payments. However, for customers who prefer to pay with credit, the draw of faster checkout options may begin to increase demand.

A contactless card is a convenient alternative for customers who don’t own devices with NFC technology or aren’t comfortable storing payment information on their phones. It’s just as easy as a mobile wallet and requires only half as much processing time as an EMV chip card.

Easier checkout means a more positive shopping experience, which brings customers back to your store and gets them talking about how convenient it is to buy from you. If you want your business to be seen as more efficient, more friendly, and an overall better choice than the competition, it’s time to start setting up new payment methods with a modernized POS or credit card payment app.

More from Business tips

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||