If you’re sick of late payments, write your invoice terms this way.

Want to get paid faster? Being clear when wording your invoice terms and conditions increases the likelihood of on-time payments and keeps your business on track for growth.

Know the standard payment terms by industry.

Sometimes clients set payment terms and don't give you room to negotiate.

Then there are industries that have standard payment terms, like net 30 invoices for manufacturing and net 30 or net 60 invoices for construction, meaning customers have 30 or 60 days to pay for goods or services. If you work in one of these industries, customers will expect you to send invoices with these typical terms.

Business owners across other industries have more flexibility to choose shorter terms and avoid lengthy payment cycles.

Send invoices promptly.

Delays in invoicing can hold up everything else in your business from payroll to growth. Furthermore, being slow to invoice when you require upfront payment holds up projects and frustrates your customers. Since invoice terms start on the date of the invoice, bill for your products and services as soon as possible. Also, make sure you know exactly where to send invoices so that you don’t have to wait for them to be passed off to the right person.

Clarify acceptable payment methods.

Offering multiple payment options allows customers to use whatever form of payment is easiest for them. Reduce payment friction by setting your business up to accept cash, check, credit cards, and mobile payments. Include a “pay now” button on electronic invoices that leads directly to a secure payment page for prompt processing.

If you’re a freelancer and clients offer you a direct deposit option, take it! Being in their payment systems means you’ll receive money on a predictable schedule.

Don’t be afraid to charge a late fee.

Late fees act like reverse incentives. When customers know waiting will cost them more, it should prompt them to pay you before the invoice terms are up. A fee of 1.5% per month is fairly standard, but you can set any reasonable fee you want as long as you state the amount clearly in your payment terms.

You may choose to do the opposite and offer an early payment discount or set both a discount option and a late fee depending on what best motivates your customers.

Say thank you.

Let customers know you appreciate their business by concluding your invoice with a personalized “thank you” message. Address the person to whom you’re sending the invoice by name, thanking him or her in advance for paying promptly. A polite reminder coupled with a note of gratitude increases the chances of receiving on-time payment.

Although there’s no magical invoice wording for immediate payment, setting clear terms and conditions upfront avoids confusion. The easier it is for customers to pay, the sooner you’ll see the money from invoices in your bank account.

More from Business tips

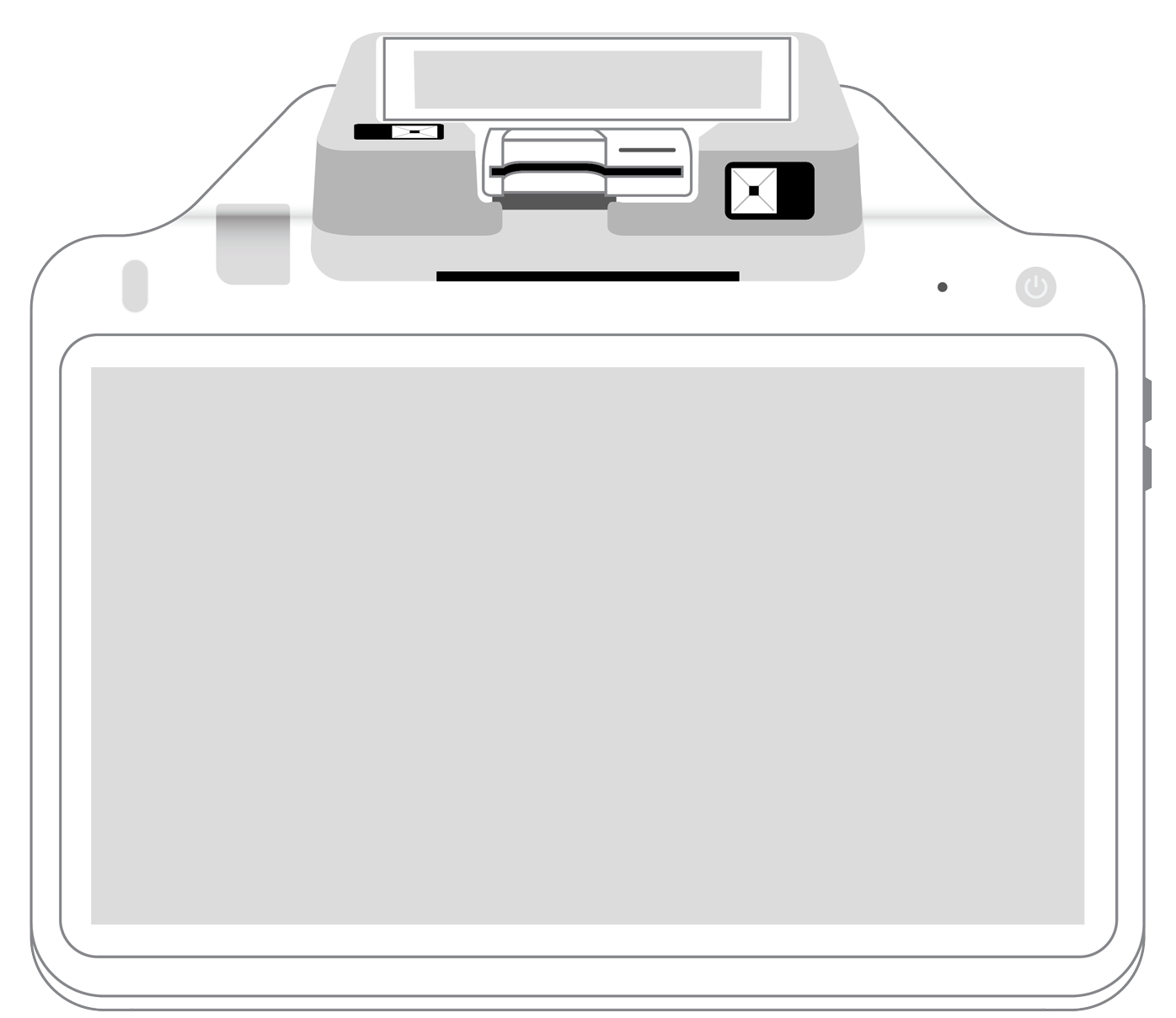

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||