How Working Capital Affects Your Business

Working capital affects the way you do business, by showing creditors, and suppliers how healthy your business truly is. Considering this equation that many use to calculate working capital: current assets – current liabilities = working capital, and you can see there is little room for error when it comes to your bottom line.

Working capital affects the way you do business, by showing creditors, and suppliers how healthy your business truly is. Considering this equation that many use to calculate working capital: current assets – current liabilities = working capital, and you can see there is little room for error when it comes to your bottom line.

So what’s a good outcome to the equation? Bigger the better, right? That’s not always the case when it comes to working capital. The people at investopedia.com explain that when you use the equation above, anything below 1 indicates a negative working capital while anything over 2 means that the company is not investing excess assets and losing out on a potential revenue source. Experts say the best ratio (answer) is between 1.2 and 2.

With this newfound information in mind, the time might be right to look into bringing additional cash to help right your business's finances. But that might raise more questions on how that can be done without adversely affecting your business. To help you, PayAnywhere has put together a list of some of the most popular non-traditional bank loan options available today:

Angel Investors.

Angel Investors are a group of entrepreneurs who have reached a certain level of success, and now are now lending both funds and business advice to the next generation of entrepreneurs. For their investment of time and money, they get equity in your company — how much depends on what you negotiate. But don’t let the name fool you, they’re offering their assistance to protect their investment.

Apply to Incubators.

There are more than 1,400 business incubators in the United States.

Forbes.com explains each of these business incubators help new startups develop their business with advice, startup services and often office space. People who graduate from the incubator process see their chances of finding funding go up significantly.

Merchant Cash Advance.

For the more established business, a merchant cash advance might be the best choice for an influx of cash to help with your working capital issues. The huffingtonpost.com explains Capital for Merchants this way "In as little as 72 hours, and without costly fees and stringent qualifications, you can receive up to 500,000 to fund your business. In return, they receive a small percentage of your credit card receipts. This works great for restaurants, bars, beauty salons, auto shops, retail stores, and just about any type of small business."

Many of the options on this list are for start-up businesses and leave many business owners by the wayside. Capital for Merchants works with more of the established business owner (6+ months) and will happy to answer any questions at 877-457-4483 or email us on a how a merchant cash advance can help your business.

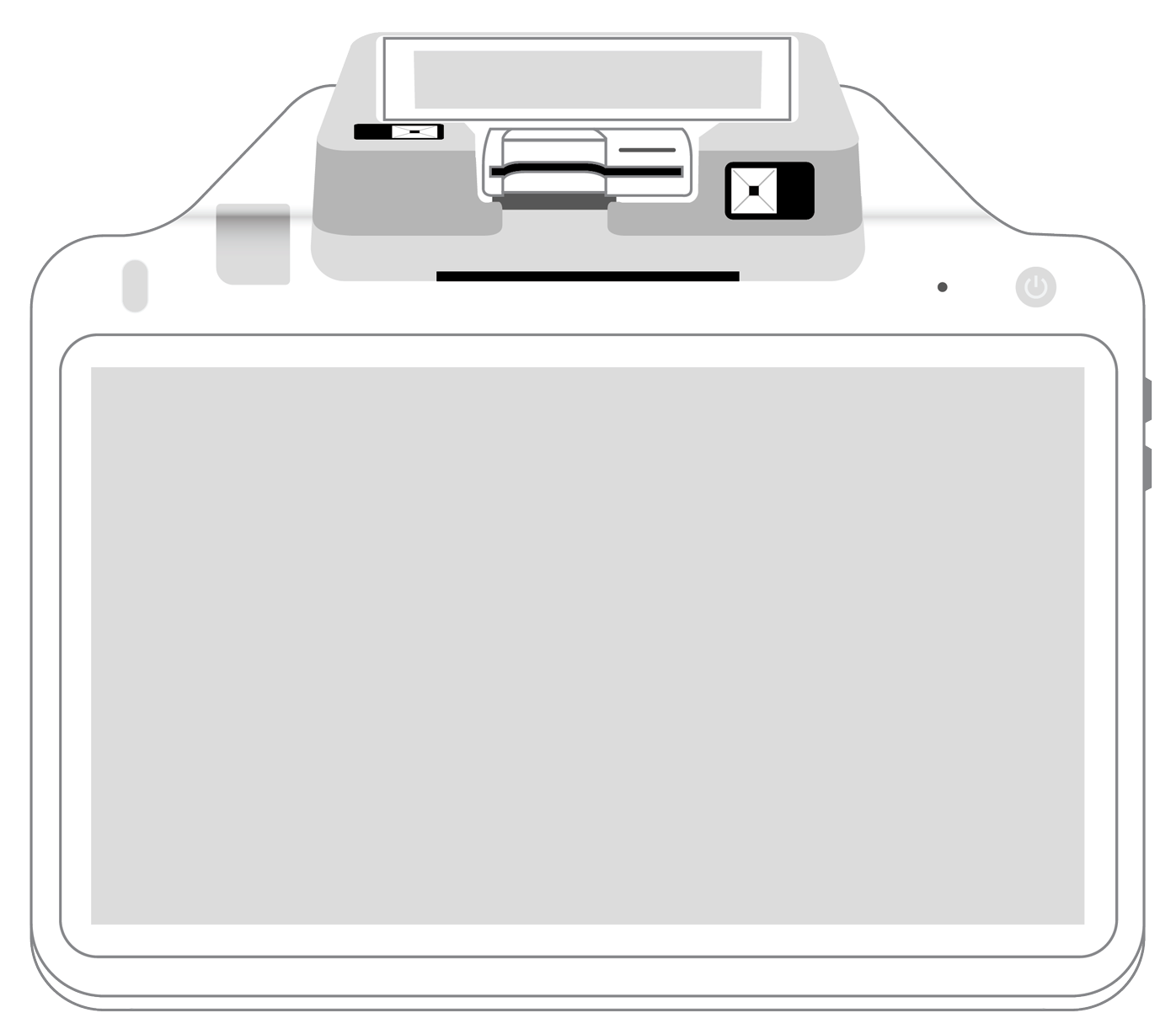

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||