How to decide which credit cards to accept at your business.

Part of the decision to accept credit card payments involves choosing which cards you’ll take. Whether you restrict payments to a few card providers or aim for universal acceptance depends on your particular needs and sales goals.

Consider the fees.

All credit card processors charge businesses interchange fees for transactions. These fees can range from 1.55 to 3.5 percent, are adjusted regularly, and may vary by card type with debit card fees tending to be the lowest.

It’s also common to be charged an additional flat fee for each transaction. This makes small transactions more expensive because a higher overall percentage of the total sales amount goes toward fees. Additional payments may include chargeback fees and fees for insufficient funds. Businesses in high-risk industries can also expect to pay more per transaction.

Consider your processing options.

Merchant service providers charge fees of their own, which may include:

- Setup fees.

- Monthly subscriptions.

- PCI compliance.

- IRS reporting.

Some providers charge an additional terminal fee, while others allow you to buy a terminal outright. Your merchant services provider will usually dictate which cards you’re able to accept. Mastercard, Visa, and Discover are the most common. In the past. American Express wasn’t as commonly used due to higher fees, though this is no longer the case and it is now more widely accepted.

Consider your customers.

Let your customers’ shopping and payment habits guide you when assessing processors and fees. Are they reliable when it comes to making payments? Do you get a lot of chargebacks or have problems with debit accounts being too low on funds? Is the average transaction large enough to offset your processing fees?

Customers also tend to prefer a specific card type or provider, especially if the rewards program is attractive. Using past sales data, determine the most popular cards among your customer base. Then, decide which card providers you can include or restrict without upsetting the majority of your patrons.

Consider the benefits.

Depending on how your customers like to pay, just choosing a cheap credit card reader and sticking with the merchant service provider charging the lowest fees might not be the smartest idea for your business. Offering a wider range of payment options, including multiple credit card types and different ways to pay, tends to bring in more customers, which should lead to an increase in sales. Bigger transactions are cheaper to process and you could potentially save even more by using a point of sale system designed to integrate with your bookkeeping software. Integration reduces the amount of time spent on accounting tasks and cuts down on potentially costly errors.

It may take some trial and error to strike a balance between offering convenience, minimizing processing fees, and maximizing sales when choosing which payment methods you’ll accept. So, be sure to pay close attention to your sales, listen to feedback from customers, and adjust your strategy until you find the most cost-effective and expedient combination.

More from Business tips

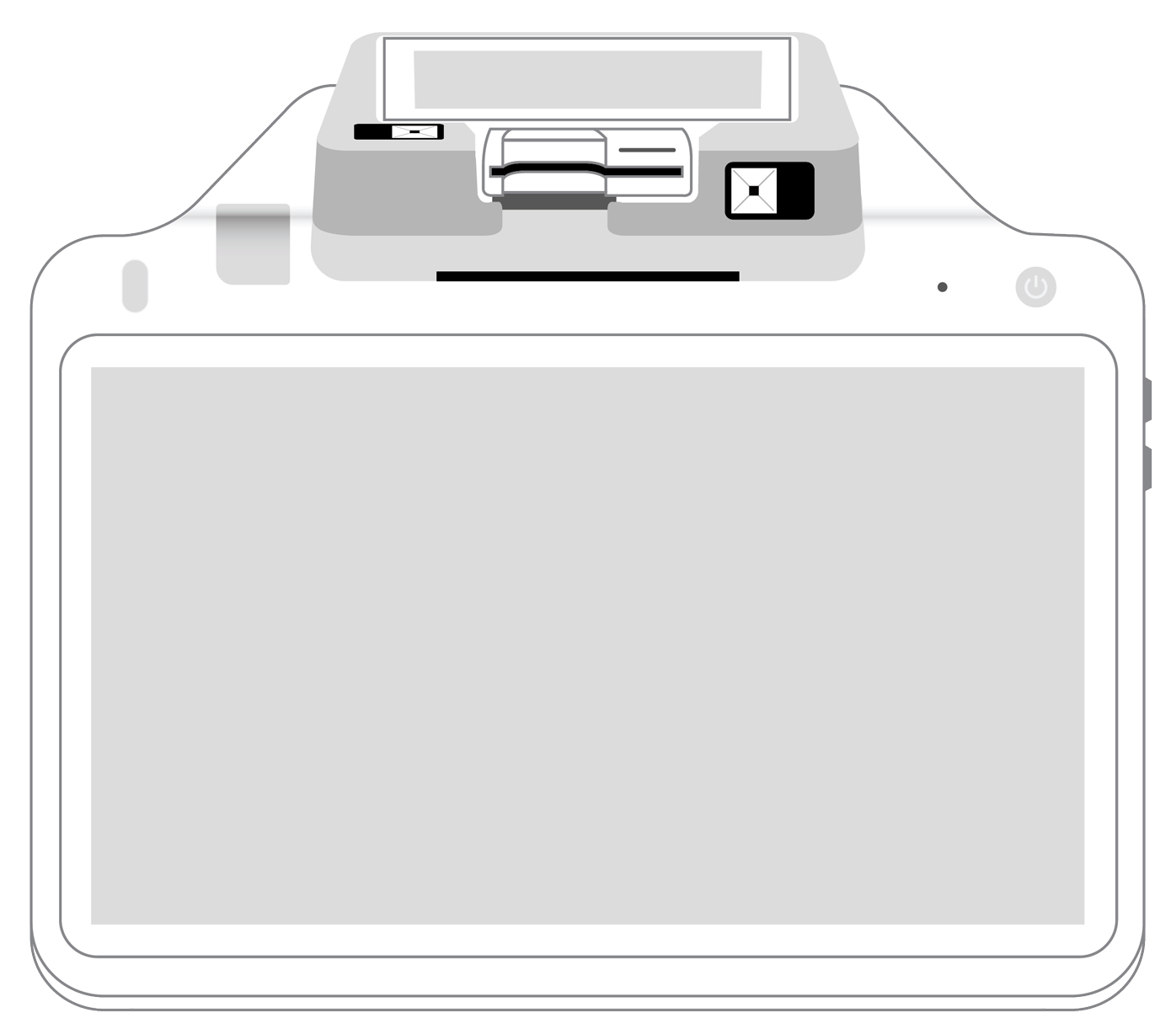

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||