Here’s why your business should be accepting mobile payments.

The global use of mobile payments is forecasted to reach 28% by 2022, suggesting that consumer interest in faster, more convenient payment methods is increasing. Whether you upgrade your in-store point-of-sale (POS) system or accept payments with your smartphone, adding mobile options can give your business a boost.

Improve efficiency to serve more customers.

Mobile payments are much faster than other payment methods. Efficient payments reduce the number of times customers have to wait in line, which is critical during holidays and other times when sales volumes are high. If you run a restaurant, mobile payments speed up table turnover by allowing customers to pay quickly at their tables instead of waiting for servers to take payments to the cash register and return with a receipt.

Expand into younger markets.

As of 2018, young consumers were leading the way in mobile payment adoption. Forty-nine percent of shoppers in Generation Z and 48% of millennials prefer to pay with their phones, citing faster service and more efficient payments as the biggest perks. Whether or not your business can benefit from this trend depends on the target audience for your products and services, but if you’re trying to attract the younger generations, adding mobile payments is an easy way to get them in the door.

Gain better insights into your audience.

Point-of-sale (POS) systems with mobile payment options often offer additional functionality through integrations that allow you to track customers’ purchasing behaviors. Customer data is stored in the cloud whenever you ring up purchases in your store or accept payments with your smartphone at an event. Remember: the more information you have on file, the easier it is to provide personalized service and design targeted marketing campaigns.

Do more with loyalty programs.

Bringing customers back to your store is easier and more lucrative than trying to attract new ones. People who return to your place of business spend about 67% more than first-time visitors. Meanwhile, loyalty programs offer powerful incentives in the form of coupons, limited-time offers, and exclusive discounts.

It’s easy to track loyalty points and create customized discounts using the customer data you collect from purchases. Customers appreciate deals in line with their personal tastes and are likely to continue purchasing from brands providing the most relevant offers.

Streamline accounting.

Accepting mobile payments costs less in transaction fees than credit cards, which can make a big difference in your business budget if even a fraction of your customers make the switch. Accounting integrations can help you save even more by reducing the risk of data entry errors. Instead of manually inputting sales at the end of the business day, every transaction is automatically recorded at the time customers make purchases, so there’s no need to issue or retain paper receipts.

Although the use of mobile payments has been slow to grow, consumers are beginning to become more comfortable paying with their cell phones. Upgrading your POS to accept mobile payments today means you’ll be ready to serve more customers as adoptions increase, which they will undoubtedly continue to do.

More from Business tips

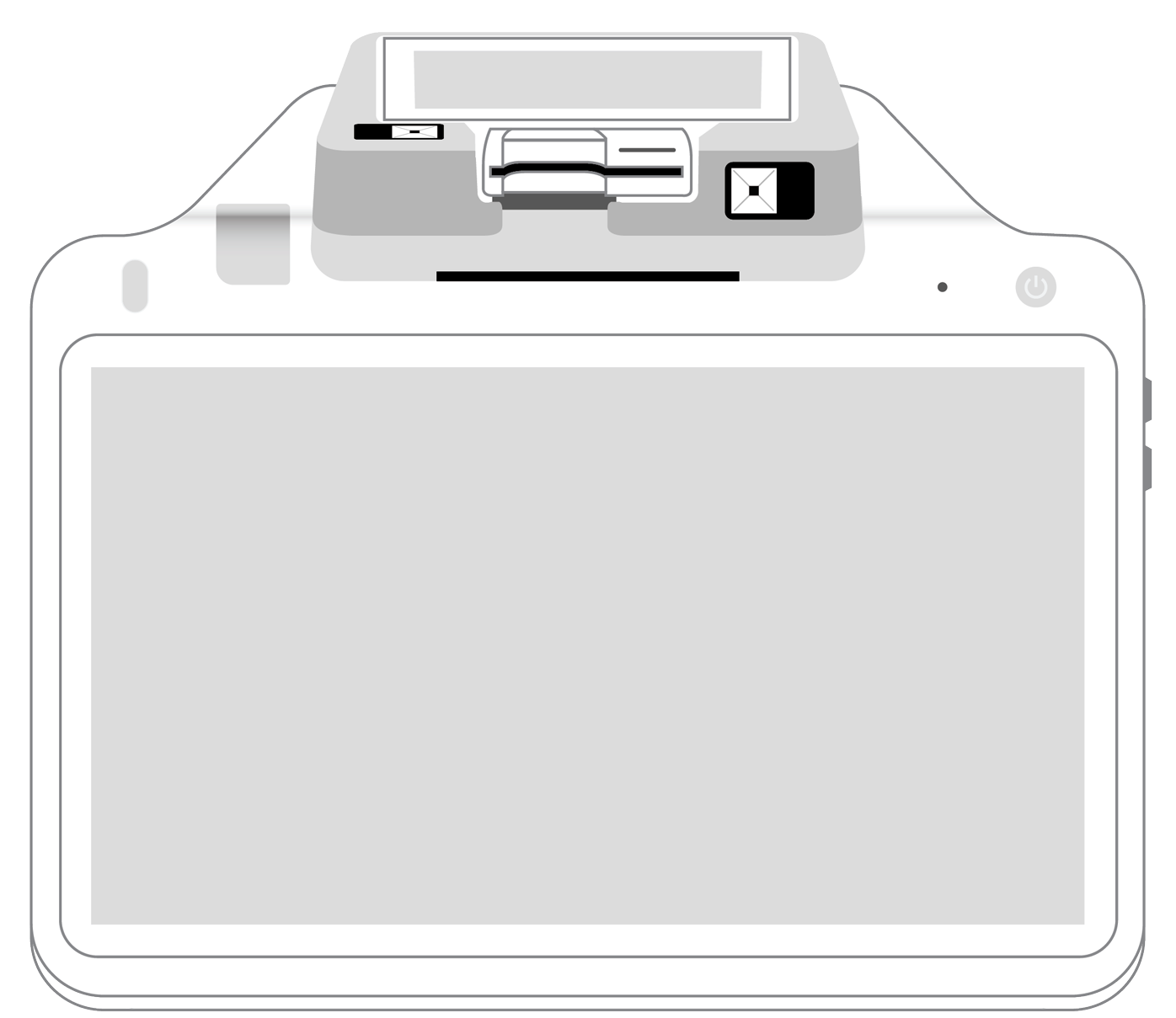

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||