Follow these 5 steps for point of sale credit card processing.

Seamless point of sale payment processing isn’t rocket science. Start accepting credit cards at your small business today with these five easy steps.

1) Shop around for merchant services.

To process credit card payments, you need a merchant services provider (MSP). When choosing one, make sure to compare pricing and fee structures from different providers, while also exploring their hardware options and the level of commitment required.

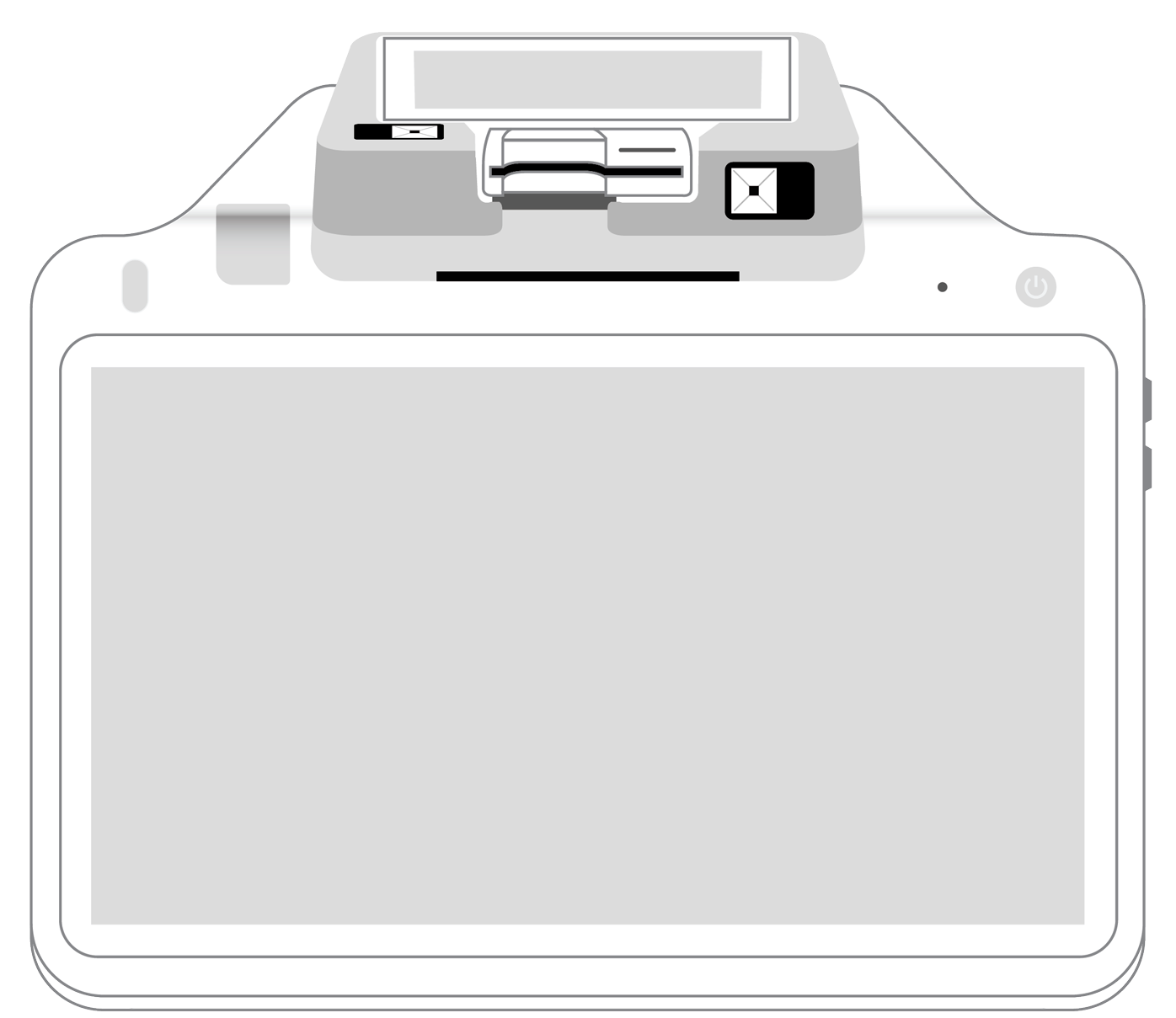

2) Choose your point of sale option.

Payment service providers offer their own equipment, such as countertop terminals and mobile card readers. Your point of sale setup can be as simple or extensive as necessary to meet your particular needs. Avoid limiting your payment processing options by investing in a scalable setup equipped with enough features to handle all common payment scenarios.

3) Optimize security.

Payment security is paramount when you accept credit card payments. Find out as much as you can about the security and fraud prevention tools MSPs use. Then, partner with the provider whose approach is most reliable. Your credit card processing solution must be compliant with all privacy and security laws and standards, such as PCI DSS. Data should always be protected using encryption during transmission and tokenization when at rest. No credit card information should ever be stored in your terminal or POS system. At Payanywhere, we give you access to PCI Plus, our PCI compliance experience that simplifies the process for most merchants to help with such issues.

4) Set up and integrate.

Countertop credit card terminals are pretty much “plug and play” while wireless terminals don’t even require a plug. You can be up and running almost as soon as you receive the hardware.

Full-service POS systems take a little longer to configure as they need to integrate with accounting programs, inventory management systems, and customer relationship management (CRM) platforms to enable full functionality and real-time updates.

5) Train your staff.

Whether your PSP offers training or you set up sessions on your own, make sure every employee learns how to process credit card payments, get appropriate confirmation of customers’ identities, and complete transactions to ensure payments are fast and seamless. Expanding your payment options with a strategic point of sale payment processing solution has the potential to boost sales and increase the size of purchases. Look for the best combination of features, price, and usability to provide your customers with a positive payment experience.

More from Business tips

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||