Disruption and the Payments Industry

By now we’ve all heard the term “disruption.” But what exactly does it mean? By definition, disruption is a “disturbance or problems that interrupt an event, activity or process.” That doesn’t exactly sound like a good thing, does it? By contrast, within today’s technology-driven world – and specifically within the payments industry – disruption can indeed be very good.

By now we’ve all heard the term “disruption.” But what exactly does it mean? By definition, disruption is a “disturbance or problems that interrupt an event, activity or process.” That doesn’t exactly sound like a good thing, does it? By contrast, within today’s technology-driven world – and specifically within the payments industry – disruption can indeed be very good.

Let’s look at another definition: “a radical change in an industry, business strategy, etc., especially involving the introduction of a new product or service that creates a new market.” It can certainly be said that the way the payments industry does business has radically changed in the last ten years.

Think about it. Would you have thought ten years ago that you could pay for goods and services with your cell phone? Or even that you could make a purchase from your back pocket or purse? Disruption can be a negative thing, especially when dealing with something or someone that doesn’t want to change. But it can also be positive, because it forces industries to create the next big thing. The way Apple Pay and Android Pay have transformed smartphone devices.

The payments industry moved rather slowly for many years, with a small number of companies making all of the decisions. But then came the digital revolution, which really sped things up and created an environment in which startups could compete with the big companies for a piece of the $5 trillion dollar US commerce pie. This disruption in the status quo has given way to an entirely new payments industry focus, one where you need to continually innovate or get left behind. This “create or die” mentality has given rise to some very unique, useful and fascinating products and services.

So what exactly does the future hold for the payments industry? An article from Wired offers insight into five digital disruption trends that are currently impacting the payments industry:

- Leveraging the power of data – credit card companies know enough about us to create customized, relevant and contextual offerings to cardholders. Using data in this way brings exciting opportunities to business but it also brings with it risk and the need for quality and efficient data management.

- The tremendous rise of new disruptive payment methods – contactless, bio-payments and mobile payment transactions are growing at incredible rates. It is estimated that mobile payments will reach $3.6 trillion dollars in 2016. Credit card companies like MasterCard and mobile payment services like Apple Pay have introduced fingerprint sensors that allow consumers to make purchases by tapping their fingers.

- Wearable devices and apps – some banks are giving customers the option to pay credit cards with a smart wristband, and most banks now have smartphone mobile banking apps that allow consumers to check balances, transfer money between accounts and make payments.

- The Internet of Things (IoT) – it is entirely probable that there will be more “things” than people on the internet, with some estimating 26 billion connected devices by 2020. That’s nearly four connected devices for every single person on the entire planet. If used effectively, IoT can auto-pay a bill that’s due soon, because your Apple Watch told your Google calendar when your payment is due. And that’s just the tip of the iceberg.

- Modernizing digital applications – based on trends over the past few years, more companies are moving legacy payment applications to cloud-based mobile solutions. Credit card companies are realizing that modernization of their legacy systems and demand for digital systems is increasing, and can be very cost effective for them.

Disruption is necessary to survive in today’s ever-increasingly digital payments landscape. Smartphones, smart watches and other mobile devices have forever changed the way we pay for goods and services, and they’re continually evolving. Using your photo, your eyes – or even your heartbeat – to pay are being discussed. Could we be looking at a future in which we only have to blink at a POS screen to pay for a purchase? Disruption, indeed.

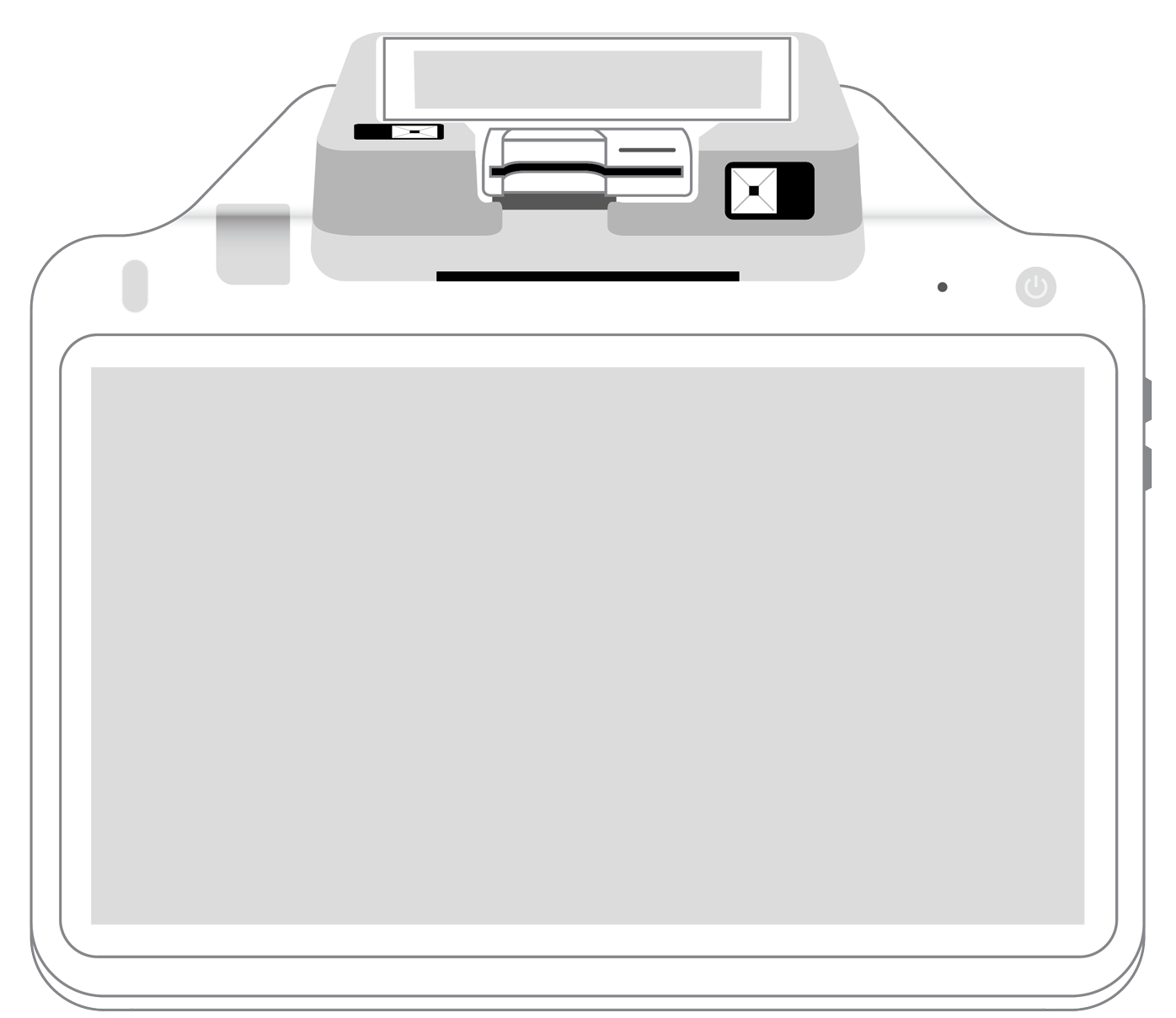

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||