6 benefits of credit card processing.

Few modern business owners mourn the demise of manual accounting procedures, while most would agree that keeping track of written receipts and ledgers was a time-consuming hassle. Worse still, it frequently led to financially costly errors. These days, with the right cutting-edge credit card processing equipment, you can interface with accounting software to facilitate and automate seamless record-keeping. If you are wondering whether bringing credit card processing into your business is a good idea, consider these main benefits.

Time savings.

As an entrepreneur, you know that time is money. Every minute that your employees spend inputting information into accounts receivable or entering it into your software is less time that they can devote to other priorities. Once you entrust those crucial but boring tasks to your software, you can free up staff to let their other talents come to the forefront.

Cash flow enhancement.

By their very nature, manually entered payments are slower and take longer to travel through your systems. Practically speaking, that means that there can be a significant lag between when invoice payment is received and when you can actually get the cash. By way of contrast, modern credit card processing systems enable you to automatically transfer invoices into your accounting software and quickly move payments into your general ledger.

Cost savings.

The simplified procedures of integrated credit card processing means that training staff is also faster and more economical. In addition, the cost of processing payments can be reduced when details are automatically submitted to the point of sale. By increasing the efficiency of your transactions, you’ll have a clear idea of where your funds are in the pipeline and will be in a far better position to take the financial pulse of your business in real-time.

Maximize productivity and workflow.

Manual entry involves a protracted and tedious process. First, a customer submits an order or brings a product to the register for purchase. A credit card payment is then made, with the relevant information keyed into the credit card processing equipment. The buyer is provided with an invoice and receipt. Later in the day, a copy of that invoice is manually marked as paid.

Credit card processing streamlines this procedure. Purchase data is simply entered into the software, which stores the details for the generation of reports whenever you need them.

Provide heightened security.

Storing and keeping track of manual payment records has been the direct cause of many business catastrophes. Cloud-based credit card software removes much of the risk inherent in keeping hard-copy records because data is stored off-site, often in a center run by a third party that has demonstrated its compliance with Payment Card Industry data security standards (PCI DSS). Should the worst happen and your business experience a natural or human-made disaster, your sensitive customer information will remain unaffected.

In the end, integrated credit card processing is a win-win for your company. With greater time and cost savings, reduced human error, more productive staff, and faster access to cash, the advantages are numerous. Isn’t it time that you used this technology to propel your business forward?

More from Business tips

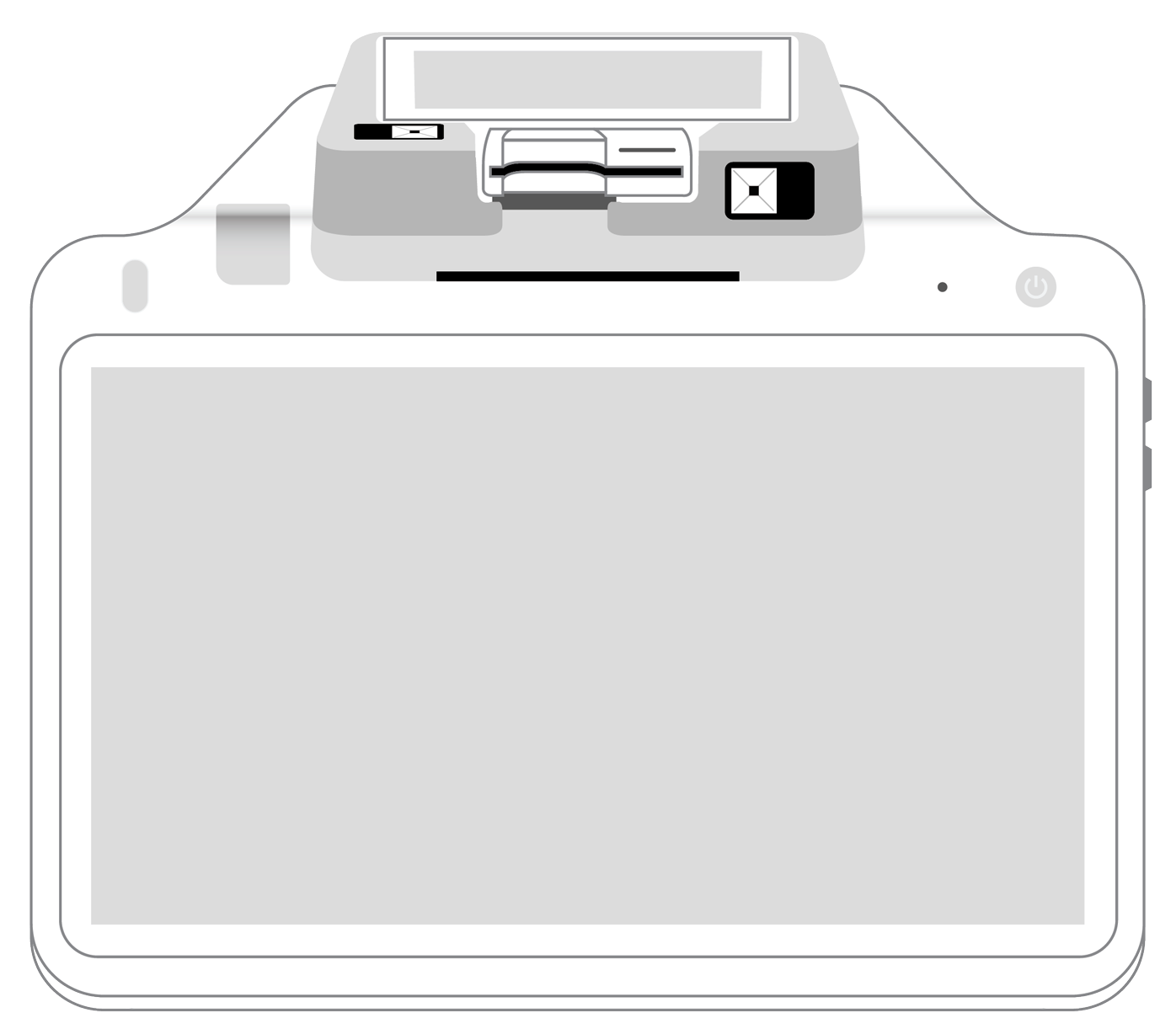

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||