5 Things to Know About Keyed-In Payments

There are times, at many businesses, when you take card-not-present transactions or have to key in payments. How can you best protect your business? Use these tips from PayAnywhere:

There are times, at many businesses, when you take card-not-present transactions or have to key in payments. How can you best protect your business? Use these tips from PayAnywhere:

1. Request card information - Make sure your customer can give you the name on the credit card, the card number, the expiration fate, the CVV2 security code and the correct billing address.

2. Obtain a signature - This one is especially important for large transactions. Have your customer sign an invoice, credit card authorization form or a contract that states your refund policies and gives you authorization to take the payment. Once this document is signed, keep it on file.

3. Have delivery confirmation - If you are shipping your product, make sure to keep the tracking information and a delivery receipt. If you are sending a large order, request a signature confirmation at delivery.

4. Get to know your customer - Before processing a large card-not-present transaction, make sure you know your customer. Check their ID, and make sure it matches the payment information they give you.

5. Match the billing and shipping zip codes - When shipping your product, check to see if the billing zip code given for the payment matches the shipping address's zip code. If they don't match, don't be afraid to ask your customer why. If their answer doesn't make sense - do not accept their payment.

Related Reading

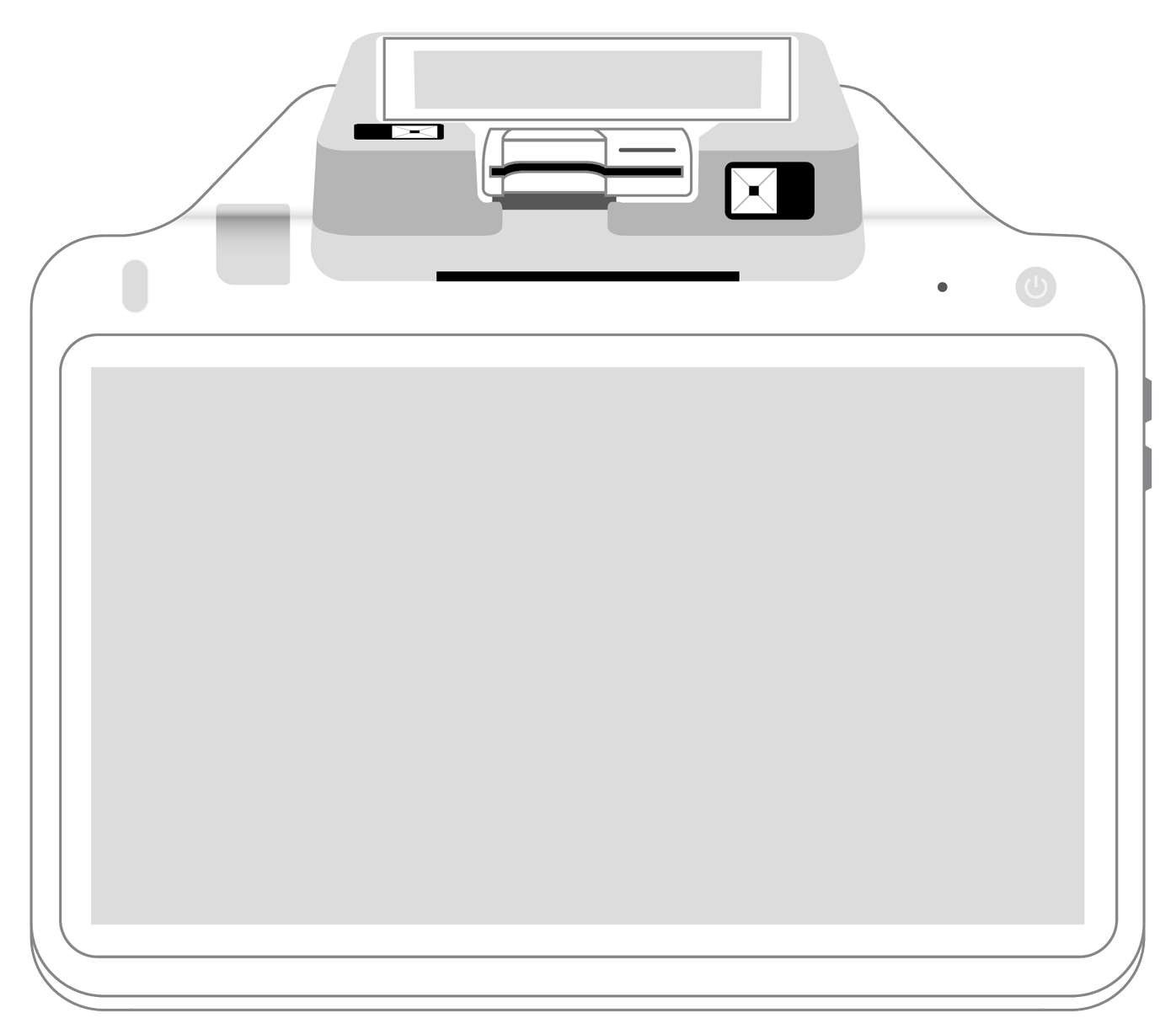

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||