3 small business payment methods you should consider for 2020.

Emerging trends in payment technology are giving customers more ways to pay than ever before. This diversification presents both opportunities and challenges to your business. As you seek ways to better serve your customers in 2020, plan to make these payment options available across all channels.

Mobile wallets.

Purchases made using mobile payment options like Apple Pay are expected to exceed a total value of $314 billion by 2020 and Generation Z may be the driving factor. These young consumers are tech-savvy and hold $44 billion in buying power, yet only 11.7% of the top 1,000 retailers were accepting Apple Pay as of 2018. This means introducing mobile wallets as a payment option has the potential to attract a significant number of new customers to your business, mostly young people looking for the speedy service and high-quality shopping experiences mobile payments can offer.

Peer-to-Peer (P2P) apps.

Many consumers use P2P apps to send money to and receive payments from family and friends. These apps offer an instant payment option to people who either don’t want to run to the bank every time they need to pay someone, or who don’t have bank accounts at all. Around 1.5 billion people have an account with a bank, but a staggering 5 billion use smartphones, making P2P payments a potentially lucrative option for your business.

However, since these apps were mainly designed for individuals rather than businesses, some restrictions remain as to how you can use them to accept money from your customers. As of now, it’s possible to incorporate P2P options into your website or mobile app, but your customers can’t pay this way at your physical store.

Credit and debit cards.

While the rising popularity of digital payment options may suggest plastic is on the way out, credit and debit cards are still the second and third most popular form of payment among consumers in multiple age groups. If you still don’t have credit card processing equipment, you’re losing sales and will unfortunately keep missing out on business from consumers across all age groups, even as other payment types become more common. The use of credit and debit cards is expected to drop slightly by 2020, but projections don’t indicate consumers are ready to abandon these payment methods just yet.

Don’t wait for the new year to start offering these payment options. Upgrade your payment system and credit card processing hardware to accept the forms of payment your customers are already using and modernize your business for faster, more efficient service.

More from Business tips

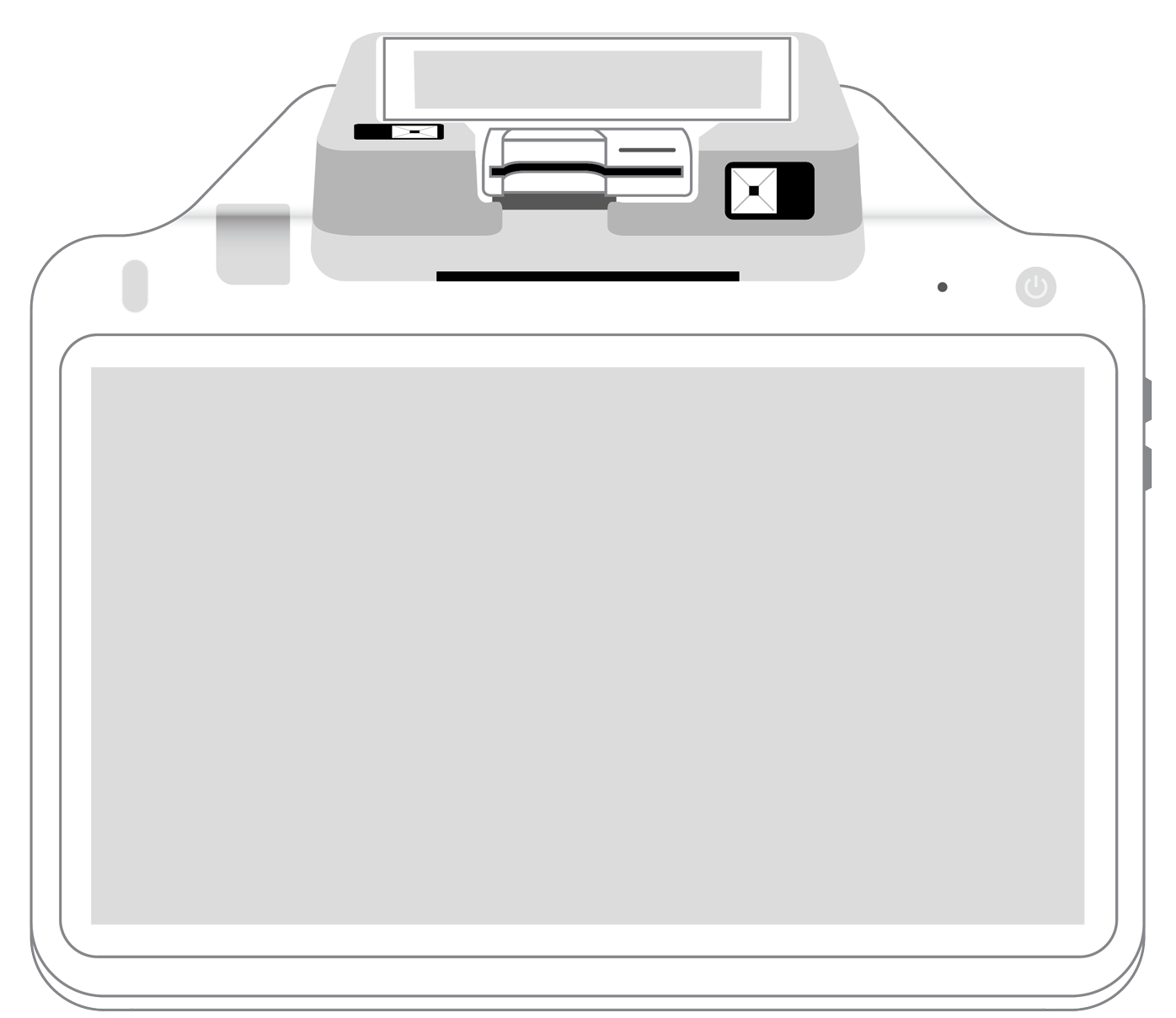

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||